AlgoTest: Simplifying Algo Trading for Everyone

Investopedia describes Algorithmic trading, or “Algo Trading using AlgoTest”, as a method where trades are executed by computer programs based on a set of predefined instructions.

Algo trading in India is on the rise, especially among retail traders. This surge is driven by brokers offering API services that enable automated trading. AlgoTest is leveling the playing field for these traders, offering free backtesting and user-friendly execution tools. This means that even traders without coding expertise can easily develop and execute their trading strategies.

The growth in algo trading was further boosted by the pandemic. The number of Demat accounts in India doubled in just two years, from March 2020 to March 2022. This period saw an influx of new traders who quickly adopted various trading strategies, including the straightforward 920 Straddle, as well as techniques like Weekly Iron Condor and monthly calendar spreads.

Creating a Winning Strategy with AlgoTest

How do you develop a successful trading strategy? In AlgoTest, the process begins with a hypothesis and progresses through backtesting, paper trading, and finally, live execution. It’s important for traders to continuously compare live results with backtest results and adjust their strategies accordingly. Here’s a breakdown of this process:

- Hypothesis: Traders start by formulating a strategy that they believe will bring good returns while fitting their risk profile. A classic example is the #920straddle strategy.

- Backtest: Traders test their strategy against historical data, tweaking it until it meets their expectations for profit and risk.

- Paper Trading: Before going live, traders simulate the strategy to ensure it works as planned.

- Live Trading: After successful testing, the strategy is implemented in the real market.

- Analysis: Constant analysis is crucial to verify that the strategy performs as expected.

Learn More: Capital Requirement for Algorithmic Trading: Myths and Facts

A Simple yet Effective 60% ROI Strategy

Let’s outline a basic strategy that can be deployed on Zerodha, involving the following parameters:

- Instrument: BANKNIFTY

- Entry Time: 9:30 AM

- Strike Type: ATM

- Action: Sell both CE and PE

- Adjusting Stop Loss for All Legs

- Stop Loss for Each Leg: 15%

- Total Maximum Loss Limit: Rs 2000

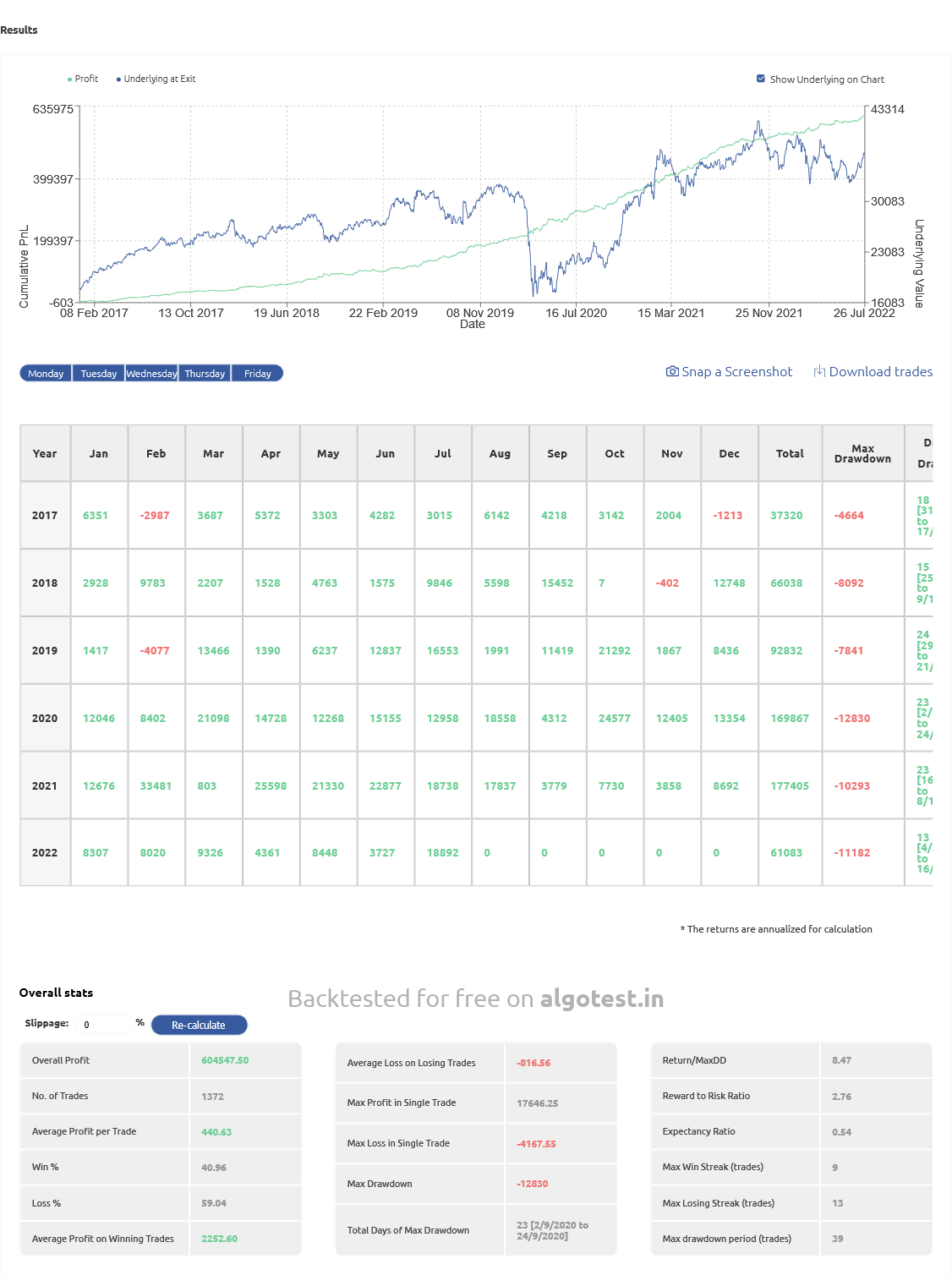

Below are the backtest results for this strategy:

Assessing the Strategy’s Performance

This strategy works best on days when the market shows a clear trend, with a 15% stop loss on individual legs. Here are the details:

Investment Amount: Rs 1.8 L

Total Gains: Rs 6 L

Annual Earnings (Over 5.5 Years): Rs 1.09 L

Annual ROI: 60%

The success rate of this strategy stands at 40%, considering that the market isn’t always trending.

Maximum Drawdown: According to Investopedia, the strategy’s maximum drawdown over 5.5 years is quite low, suggesting a lower risk compared to many long-term investments.

Profit-to-Drawdown Ratio: This ratio indicates that the annual profit significantly outweighs the maximum drawdown.

Monthly profit and loss records show consistent profitability, even during the March 2020 market crash.

Implementing the Strategy with AlgoTest

Here are YouTube links explaining how to use AlgoTest for creating, testing, and deploying this strategy on Zerodha, including helpful videos for new strategy development.

Link 1: Strategy Creation with AlgoTest

Link 2: Setting Up Zerodha for Algo Trading

Link 3: Developing New Strategies with AlgoTest

Who Stands to Gain from AlgoTest?

AlgoTest has been a game-changer, particularly for part-time traders who can now trade without constantly monitoring the markets. Full-time traders also benefit, as they can focus on crafting new strategies while AlgoTest takes care of the trading.

In summary, AlgoTest is empowering retail traders in India to compete with institutional traders by providing easy-to-use tools for backtesting and automated trading.