Understanding Short-Term Investments

In simple terms, short-term investments are funds set aside for use in the near future, typically within five years. The main goal is to earn interest on your money.

The Appeal of Short-Term Investment Schemes

Short-term investment options are ideal for meeting immediate financial goals and are generally seen as less risky compared to long-term investments. Contrary to common belief, short-term investments are not limited to the stock market.

Exploring Profitable Short-Term Investment Schemes

Here, we present five short-term investment schemes known for their excellent returns. Consider each one and pick the best fit for your needs.

Also Read: How to Become a Stock Market Millionaire in 5 Years?

1. Peer-To-Peer Lending

Without a doubt, peer-to-peer lending is among the most lucrative and flexible investment options, delivering substantial results in as little as a year or even months.

In this system, companies connect willing investors and potential borrowers conveniently and securely through their websites. Investors provide a sum as a loan and, after a set period, receive rewards in the form of repayment and interest.

One significant advantage of this system is that the loan amount depends entirely on the investor’s risk tolerance, optimizing gains. Companies acting as intermediaries set the interest rates, and strict criteria minimize the risk of losses.

Notable companies involved in this form of investment include Lending Club, Funding Circle, Prosper Marketplace, and others.

2. Online Recurring Deposit Account

An online recurring deposit account has gained popularity due to its simplicity and flexible operation. Investors can confidently set aside funds in the bank without worrying about losses since it’s a risk-free venture. The investment sum is distributed monthly, eliminating the need for a lump-sum investment. Some banks may have longer lock-in periods, but longer periods typically offer higher interest rates, benefiting both banks and investors.

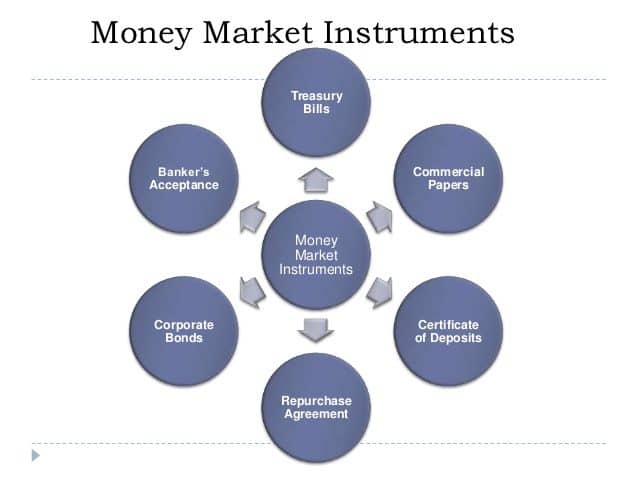

3. Money Market Accounts

Money market accounts are another notable investment plan known to produce significant benefits in the short term. Interest rates are determined based on your bank account status, regardless of the investment period. Moreover, you can easily move or withdraw invested money at your discretion without incurring losses.

4. Stock Market Investment

Undoubtedly, stock market investment is one of the best ways to multiply your money in the short term. While market risks exist, careful risk management can lead to great results. Multiple investment options, such as Equity, Derivatives, and Forex, are available. It’s a highly liquid form of investment, allowing you to withdraw your funds on the same day. A more conservative approach is investing in markets through mutual funds, offering professional handling to limit risks.

5. Short-Term Bond Funds

Short-term bond funds are an excellent investment scheme that generates income through fixed income instruments. While known for their unpredictable nature due to market fluctuations, short-term bond funds still offer some of the best returns for short-term investors. These investments typically mature within two years at most, and setting up a Demat account is necessary for this type of investment.

Also Read: Grow Your Money: The Magic of Compounding Explained

Conclusion: Finding the Right Fit

It’s essential to understand that each short-term investment option has its own set of pros and cons. Carefully weigh your choices to determine which investment plan aligns best with your unique needs and objectives. When practiced effectively, these options can yield excellent returns and potentially accelerate your wealth-building journey.

2 Comments