Venturing into the stock market without a solid plan is akin to navigating a treacherous path; your investment could vanish in an instant. The cornerstone of successful trading lies in a well-defined strategy that includes clear rules for when to enter and exit trades, coupled with effective risk management and position sizing techniques.

Diverse personalities and risk appetites call for different approaches in trading. This article delves into the four prevalent Types of Trading Strategies, shedding light on their respective benefits and potential pitfalls.

Further Reading: 3 Most Accurate Candlestick Patterns Every Trader Should Know

Trend Following: Going with the Flow

Trend following is based on the idea that markets often move in specific directions over time, driven by collective emotions and momentum. Identifying the beginning of a trend might be challenging, but once you spot it, you can profit by going with the flow.

To spot a trend, you can visually examine charts or use indicators like moving averages or MACD. While trend following can be very profitable, be prepared for drawdowns during sideways market movements.

“Trend following suits those aiming for high profits and who can tolerate moderate to high risks.”

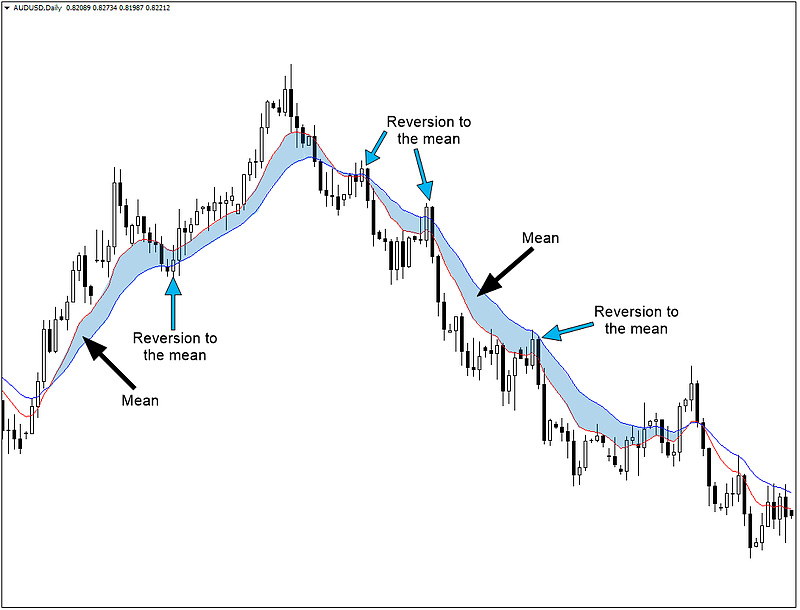

Mean Reversion: Betting on Normalcy

Mean reversion operates on the belief that stocks will return to their average price, which represents their true value. Deviations from this mean price indicate trading opportunities. Essentially, this strategy involves buying low and selling high.

Markets tend to fluctuate around the mean price, allowing investors to use this pattern for their investment strategies. Technical tools like Bollinger Bands and RSI are useful for detecting mean reversion opportunities.

“Mean reversion strategies suit those seeking small, frequent profits.”

Discover a mean reversion trading system in Amibroker here.

Pair Trading: Exploiting Correlations

Pair trading exploits the correlation between two trading instruments. For instance, equities and gold often move inversely. This strategy looks for deviations from historical correlation stats.

Pair traders observe correlated stocks and take positions when the correlation weakens, going long on one and short on the other. The expectation is that when correlation strengthens again, one position will offset the other, yielding a profit.

“Pair trading is ideal for those with higher capital, seeking moderate returns with minimal risks.”

Explore a pair trading strategy in Excel here.

Arbitrage: Capitalizing on Price Differences

Arbitrage involves taking advantage of price differences for the same security across different markets. The assumption is that prices will converge by the end of the trading day, despite significant intraday variations.

Arbitrage opportunities also arise from unusual differences between spot and futures prices. For example, if the futures premium over spot unusually widens, you might short futures and buy the spot, expecting them to converge.

“Arbitrage is the safest strategy, suitable for those seeking minimal risk at the expense of limited trades annually.”

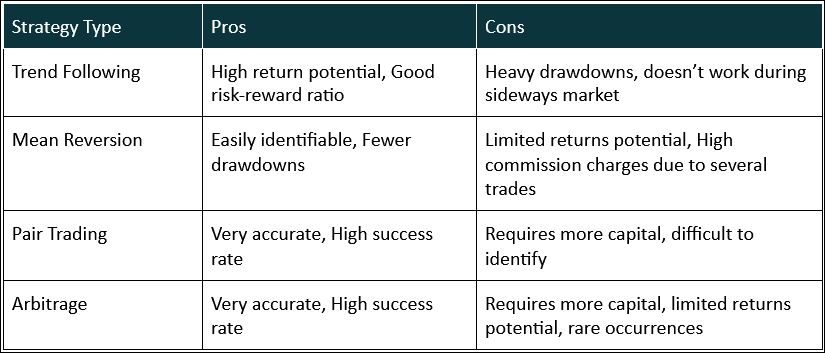

The table below compares the pros and cons of each strategy:

Ultimately, each of these trading strategies has been time-tested and is worth considering. However, it’s best to focus on one strategy at a time. Evaluate each strategy’s pros and cons to determine which aligns best with your trading style and risk tolerance. If you’re unsure where to start, trend following is often a good choice due to its simplicity and potential for high profits.

One Comment