Amibroker holds a prominent position as one of the most widely used trading platforms, celebrated for its robust feature set. However, it may appear daunting to newcomers due to its high cost and steep learning curve. In this article, we will explore alternative trading software options that are well-suited for the Indian stock market. These alternatives not only offer more budget-friendly options but also provide user-friendly interfaces tailored specifically for NSE and BSE stocks. It’s essential to clarify that our aim is not to discourage traders and investors from acquiring an Amibroker license; rather, it’s to introduce them to alternative choices.

Also Read: Best Technical Analysis Courses in India

1) Investor Trading Platform:

This application is desktop-based and designed for conducting technical analysis. Upon purchase, it comes pre-loaded with backfill data, the amount of which depends on your subscription level. Furthermore, the software offers a wide range of technical indicators and is equipped with alert and screener features. Charting can be performed across various timeframes, including intervals as short as 1 minute.

Pros:

- The charts load smoothly with virtually no time lag.

- It comes with sufficient backfill data out of the box, eliminating the need for separate data purchases.

- The interface is exceptionally smooth and intuitive.

- Learning to use it is relatively straightforward, with numerous online tutorials and webinars available.

- The screener feature is robust and user-friendly.

- Himanshu Patil, the founder of Investar India, conducts informative free technical analysis sessions for annual subscribers.

- It also offers fundamental analysis features.

- The multi-timeframe analysis feature is valuable for advanced traders.

Cons:

- It lacks a backtesting feature, preventing users from coding and testing strategies.

- Customer support is often slow in responding to emails.

- Compared to other tools in the market, it is relatively expensive. At the time of writing this article, the yearly subscription with all features costs around 25K.

2) TradersCockpit:

It is another powerful trading platform with advanced features. It is web-based and does not require any downloads or installations on the local machine. What sets it apart is its robust backtesting feature.

Pros:

- It has a web-based interface, making it accessible from any computer or handheld device worldwide.

- It boasts a powerful Options module for testing and evaluating option strategies.

- Users can backtest trading strategies across a variety of instruments.

- It supports Tradescript language, known for its ease of learning and coding.

- Impressive customer support, including assistance in coding and backtesting strategies.

- Webinars are conducted weekly/on-demand.

- Alerts generated through the trading strategy can be sent via SMS.

- Forum access for subscribed customers.

Cons:

- Charting is not as user-friendly and intuitive as other platforms.

- The Java-based interface may not be visually appealing to all users.

- Backtesting engine performance is slower compared to Amibroker.

- Insufficient backfill data available.

- The screeners are not user-friendly.

3) iCharts

iCharts is a web-based technical analysis platform. It is lightweight and easy to use, equipped with basic charting and backtesting features.

Pros:

- It is lightweight and loads quickly.

- Platinum charts are based on Microsoft Silverlight, providing a visually appealing alternative to traditional Java-based charts.

- It comes with 80+ technical indicators.

- Users can create custom indicators.

- Provides the option to backtest strategies.

- Supports Tradescript language for easy learning and coding.

- Subscription is cost-effective compared to its peers. At the time of writing this article, the yearly subscription of Platinum service costs below 15K.

Cons:

- It’s a basic platform and not suitable for advanced technical analysis.

- Backtesting capabilities are limited.

- Updates are infrequent.

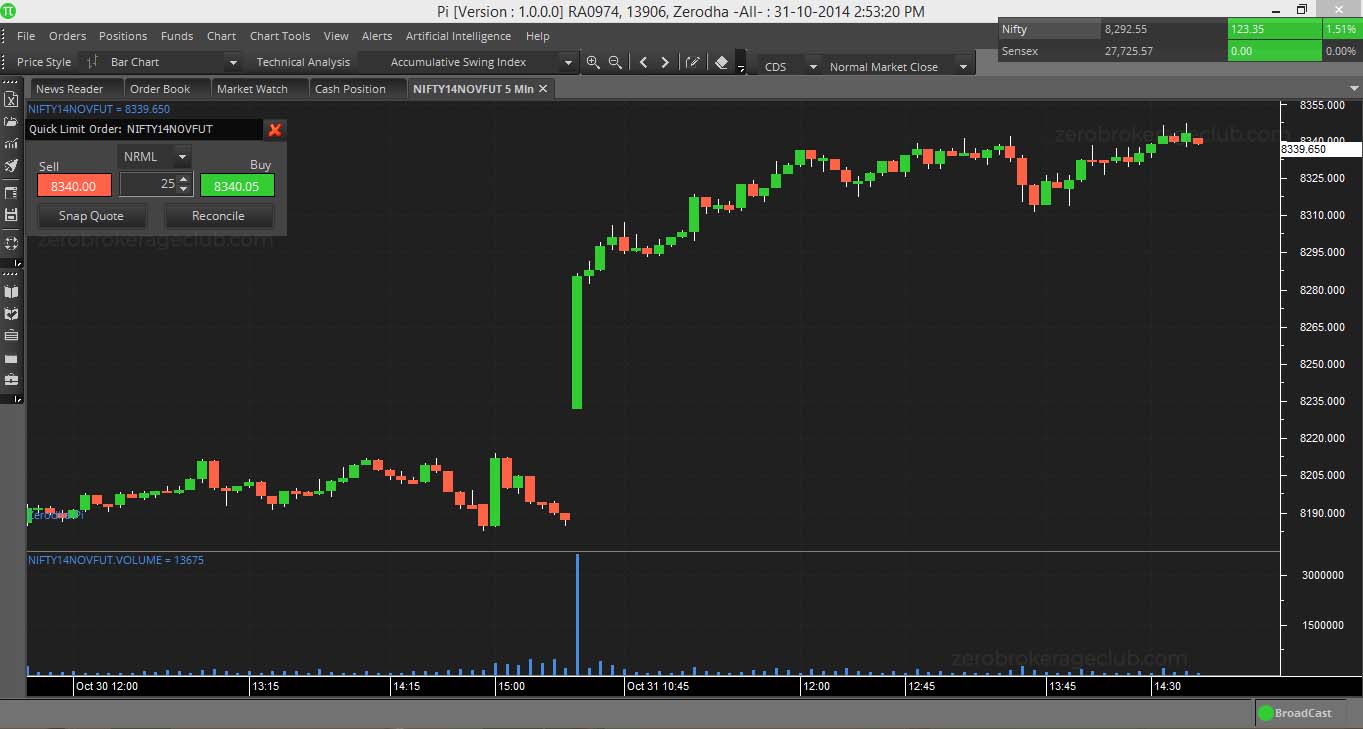

4) Zerodha Pi

Pi is a popular trading platform from Zerodha. It is exclusively available to Zerodha customers and allows direct Buy/Sell orders through the chart.

Pros:

- It offers a neat and clean interface.

- Provisions for backtesting and creating custom indicators.

- Buy and Sell orders can be placed directly through the chart.

- Integration with Amibroker for semi-automated trading.

- Advanced features include Artificial Intelligence and neural networks.

- Supports Tradescript language for easy learning and coding.

- Free of cost for Zerodha customers.

Cons:

- Backtesting capabilities are not as robust.

- Available exclusively for Zerodha customers.

- Pi is a relatively recent release and may not be as stable as other tools.

Final Verdict:

We have reviewed 4 different trading software options in India. Each platform has its unique features, and the final choice depends on your trading style.

- If you are a Zerodha customer, go for Pi. You’ve got a great deal, and it’s free of cost.

- If you are a Price Action trader seeking a clean and user-friendly interface with multi-timeframe support, choose Investar over others.

- If you are an Options Trader or require extensive backtesting, then TradersCockpit is a suitable choice.

- Finally, if you are new to technical analysis and want a cost-effective option, iCharts is ideal for you.

If you have come across any other trading software options in India, please share them in the comments section below.

One Comment