Demystifying Crude Oil Technical Analysis: Crude Oil Technical Analysis is all about applying technical indicators to decode the trends in crude oil prices for strategic trading. Recognized for its high volatility, crude is actively traded 24/7 worldwide. The recent drop in prices has sparked increased trading interest in this sector.

Unlocking Trends with Technical Analysis: This analysis method reviews current price data over select periods. It typically involves breaking down data into categories like ‘Moving Averages’ and ‘Oscillators,’ using tools such as the volatility index. Technical analysis is particularly useful for setting critical trading benchmarks like stop losses or profit targets, allowing traders to refine their strategies at crucial price levels.

The Art of Applying Technical Indicators: While using various technical indicators is recommended, traders should be aware that Crude Oil Technical Analysis is an advanced approach requiring deep sector knowledge to maximize gains. Accurate analysis requires a thorough consideration of multiple parameters.

Further Reading: Mastering MCX Crude Oil Trading: A Simple and Profitable Strategy

Crude Oil Technical Analysis Vs. Fundamental Study

Key Differences Explained: The primary distinction between Crude Oil Technical Analysis and fundamental analysis lies in their approach. Fundamental analysis is based on supply-demand dynamics and future forecasts, whereas technical analysis predicts future trends and price levels using historical price and volume data.

While many traders combine fundamental and technical analysis, mastering the technical aspects can be more challenging. These indicators are pivotal for predicting market trends and forming trading strategies.

Interpreting Market Signals: Fundamental analysis is the backbone of comprehensive commodity research, whereas technical analysis plays a critical role in enhancing trade returns, and adding significant value to long-term investments.

Diverse Signals, Varied Time Frames

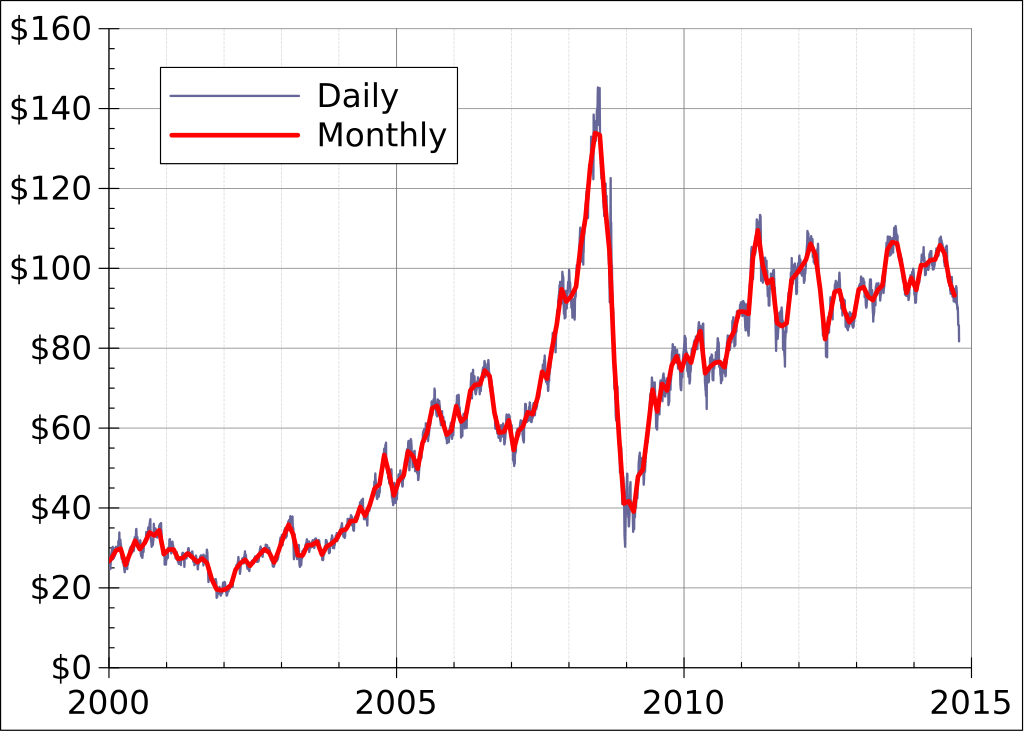

Interpreting Signals Across Time Frames: In Crude Oil Technical Analysis, understanding how signals vary across different time frames like monthly, yearly, or daily is essential. The same signals can imply different trading actions based on the selected time frame, offering deeper market insights and identifying key trends.

These insights are crucial in shaping trading strategies and deciding on the frequency of trades.

These insights are crucial in shaping trading strategies and deciding on the frequency of trades.

Precision in Technical Trading: Accuracy in time frames and price points is vital in Crude Oil trading. Understanding and applying these accurately enhances the reliability of technical predictions.

Strategies for Profitable Crude Oil Trading

Navigating Profitability: Achieving profitability in Crude Oil involves carefully navigating market trends. The 24/7 trading nature of crude oil markets means traders must be cautious of market sentiment and avoid common pitfalls like herd mentality. Understanding and aligning with the primary trend is key to maintaining profits over time.

Further Reading: How to trade in Commodity Market without Loss? 5 Proven Steps

Understanding Nymex and Brent Crude

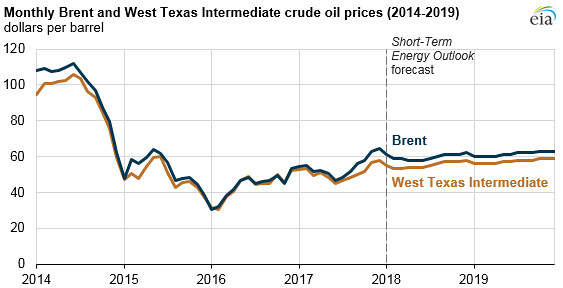

Different Markets, Different Approaches: In Crude Oil, differentiating between Nymex and Brent crude is crucial. Nymex crude trades on the New York Mercantile Exchange and is based on West Texas Intermediate crude prices.

Brent crude prices, derived from the North Atlantic fields, are considered more globally representative. Accurate technical analysis requires understanding these pricing differences.

Long-Term Price History in Focus

Importance of Long-Term Trends: Long-term chart analysis is vital for successful trading in Crude. Studying these trends helps identify broader market directions and predict future price movements, crucial for long-term trading strategies.

Conclusion

Mastering Crude Oil Technical Analysis: Effective Crude Oil Technical Analysis hinges on a deep understanding of market dynamics and crowd psychology. Balancing various factors like market reactions, derivative movements, and the volume-price action ratio is essential for making informed trading decisions.

One Comment