Embarking on your journey into the Stock Market might have you bumping into the term ‘SGX Nifty‘ quite often. This piece will unravel the intricacies of this concept, shedding light on its influence over Indian and global markets alike.

Exploring the Concept

Known alternatively as the Singapore Nifty, it operates as a derivative of the Indian Nifty index, establishing its trading arena on the Singapore stock exchange. Its movement notably parallels the Indian Nifty index. Not all Nifty stocks secure a spot for trading on the Singapore Exchange. Furthermore, the latter, a key actor in Asia, accommodates not only Indian Nifty trading but also opens the floor for other significant global indices.

Read Also: Mastering Risk Management: Strategies for Traders

The Significance of this Trading Index

Unlike the NSE’s approximately 6 hours, trading Nifty Contracts in Singapore spans over an extensive 16-hour window, presenting global investors with a flexible trading environment free from timezone constraints. Additionally, Singapore, known for its adaptable market, boosts the visibility of Indian stocks via this notable index. This platform serves as a conduit for investors aiming for exposure to Indian markets, especially those who might find direct access challenging. Initiating trading nearly 3 hours before the NSE, it offers Indian investors insightful foresights into possible market openings. Even when Indian markets take a pause, developments influencing them are mirrored in this trading index, offering a sneak peek into potential market situations once trading resumes on the Indian market. Additionally, it introduces arbitrage opportunities. On the flip side, its existence generates several challenges for Indian policymakers, touching upon aspects like transaction costs, ease of doing business, financial market integration, and concerns related to potential bypasses of Indian markets due to various delays.

Read Also: Boost Your Earnings: 10 Points Daily with NSE Nifty Investment

Live Charts and Movement

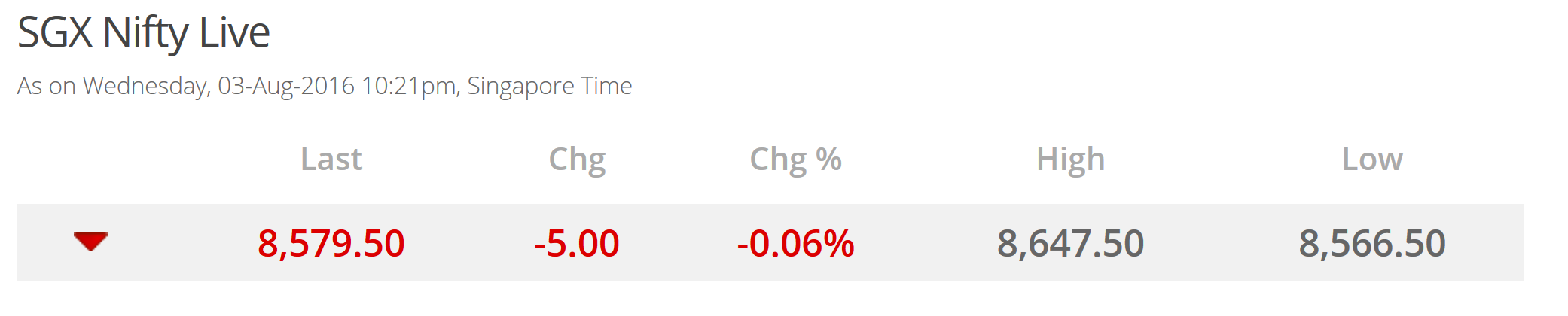

Tracking its symbol might be tricky on well-known finance platforms like Yahoo and Investing. Nevertheless, you can closely monitor its price movements using the following links:

Take a glance at some screenshots below:

The Horizon of this Notable Index

Insights from the Economic Times hint that the foreseeable future will usher in the trading of futures contracts on specific Indian indices in Singapore. The Singapore Exchange is actively preparing to enlist dollar-denominated index futures contracts like Nifty Bank, Nifty IT, Nifty CPSE, and Nifty Midcap 50. This initiative marks the first instance of such derivative contracts being available outside India. Presently, the Exchange provides futures for the SGX Nifty 50 Index, which has carved a niche among international participants seeking offshore exposure to the Indian benchmark index. In 2015, SGX Nifty 50 Index Futures witnessed a 30% surge in volume year-on-year, touching $360 billion. Moreover, the Exchange’s rupee-dollar futures contract has evolved into its most actively traded forex future, accumulating over $750 million in notional trades daily. The anticipated launch dates are March 29 for Nifty IT Index Futures and Nifty CPSE Index Futures, while Nifty Bank Index Futures and Nifty Midcap 50 Index Futures are expected to follow in mid-2016. The introduction of sector index futures contracts is set to bolster the Exchange’s Indian product suite, granting offshore investors focused trading possibilities in prime sectors of the globe’s most rapidly expanding economy, as per NSE.