Moving Average-based trading systems are widely popular among global traders, especially in trending markets. We’ve introduced such a system in our AFL of the week:

AFL of the week: 14-73 EMA crossover system

Many beginners might not have a subscription to Amibroker with continuous data feed. So, we’ve attempted to create a semi-automated Moving Average trading system in Excel. The only manual task required is copying the closing price for the selected security in this Excel sheet.

Strategy Overview

| Parameter | Value |

|---|---|

| Preferred Timeframe | Daily |

| Indicators Used | 3 Days EMA, 5 Days EMA |

| Buy Condition | 3 Days EMA is above 5 Days EMA |

| Sell Condition | 3 Days EMA is below 5 Days EMA |

| Stop Loss | No fixed target; stop and reverse when Excel provides the opposite signal |

| Targets | No fixed target; stop and reverse when Excel provides the opposite signal |

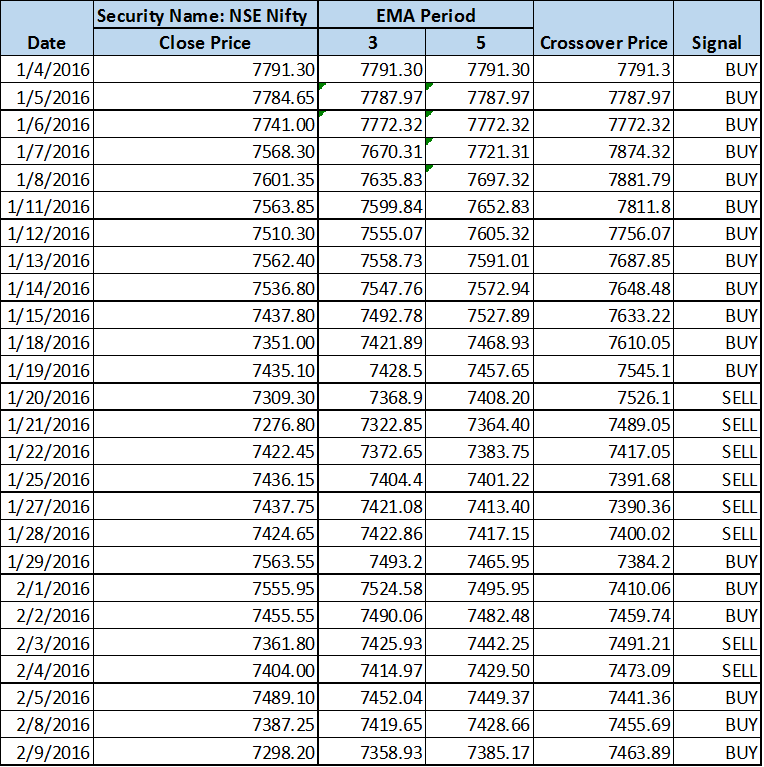

Excel Sheet

| Parameter | Description | |

|---|---|---|

| Worksheet Name | MA Trading System | |

| Inputs | Date (Column A) | Calendar Date |

| Close Price (Column B) | Closing price on the specified Calendar Date. | |

| Faster EMA Period (Cell C2) | Faster Exponential Moving Average. Default is 3. | |

| Slower EMA Period (Cell D2) | Slower Exponential Moving Average. Default is 5. | |

| Outputs | Faster EMA Values | Faster EMA values are based on the period defined in the input. |

| Slower EMA Values | Slower EMA values are based on the period defined in the input. | |

| Crossover Price | The exact price at which the EMA crossover will occur. | |

| Signal | Buy/Sell signal based on the conditions mentioned in the strategy overview. | |

Screenshot

5 Comments