Discover how to double your money in just 6 months. It sounds intriguing, doesn’t it? Achieving this isn’t easy, but it’s not impossible either. Discipline and determination are the keys to success in this endeavor.

Before we proceed, let’s assume you have no additional resources or assets to help you achieve this return. You have an initial investment of 100,000 Rupees (INR), and your goal is to grow it to 200,000 Rupees within 6 months.

Step 1: Open a Trading Account

Start by opening a trading account with a reputable discount broker. Opt for all available segments, including equity, F&O, currency, and commodities. This may be free or may cost you a maximum of 500 Rupees. If you’re in India, we recommend opening an account with Zerodha or RKSV. Research the discount brokers available in your country with a simple Google search.

Step 2: Learn About Markets and Share Trading

Assuming you have zero knowledge of markets, explore free online courses to understand capital markets. Pay special attention to currency markets and the factors influencing currency pair movements. Consider paper trading to boost your confidence. We recently published an interesting article on where and how to learn about markets.

Stock Market Learning Essentials

Step 3: Evaluate Margin Requirements

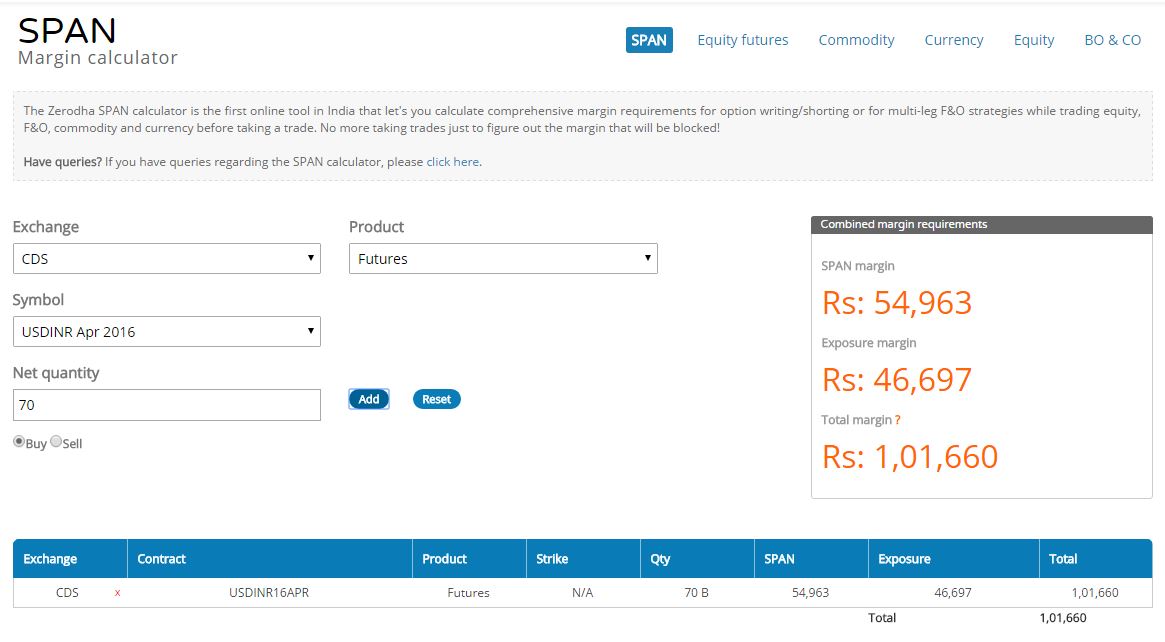

Review the margin requirements for various securities on your broker’s website. You’ll notice that the highest available margin is typically for currency futures. Learn more about margin trading here. With Zerodha, you can buy 70 lots of the USD-INR pair for 100,000 Rupees. This translates to a real value of 70,000 USD or 4,690,000 Rupees (1$=67 INR). With just 100,000 Rupees in your account, you can trade for 4,690,000 Rupees. This is the magic of margin trading, and you now need a 2% return in 6 months.

Step 4: Develop Your Trading Strategy

Predicting the movement of the USD-INR currency pair will be crucial for your investment growth. I recommend learning technical analysis and creating a trading plan. Stick to this plan for the next six months. If possible, backtest your system using tools like Amibroker. Assuming you can correctly speculate the market 30% of the time, meaning 3 out of 10 trades are profitable, find our Amibroker Trading system for USD-INR with a backtest report in the link below:

AFL of the Week: USD-INR Currency Trading Strategy

Step 5: Implement Risk Management

Risk management is critical for any Trading system’s success. Aim to maintain a risk-reward ratio of at least 1:3, meaning the profit target should be 3 times the stop loss. For example, if your profit target is 0.3 points and the stop loss is 0.1 points, read about our risk-reward calculator here.

Step 6: Achieve Your Target

Assuming you make one trade every day, with approximately 20 trading days a month, you’ll have roughly 120 trades over 6 months. Out of these, 36 will be winning trades, and 84 will be losing trades (with a 30% success rate). If you earn 0.3 points for winning trades, your total profit would be 0.3 * 70,000 * 36 = 756,000 Rupees. If you lose 0.1 points per losing trade, your total loss would be 0.1 * 70,000 * 84 = 588,000 Rupees. Therefore, your total effective profit would be (756,000 – 588,000) = 168,000 Rupees. After subtracting brokerage and other charges, your total effective return would be close to 100,000 Rupees. TARGET ACHIEVED!!!

We haven’t factored in compounding in the above steps; otherwise, the return would be even higher. Doubling your money in 6 months, even with just a 30% success rate, is achievable. However, there are a few challenges that make this task challenging:

- The human mind tends to limit profits and let losses grow. We often think that a losing trade will become profitable over time, which can negatively impact the risk-reward ratio.

- The sequence of profits and losses plays a crucial role in calculating effective returns. In the example above, if you experience 15 consecutive losses, you could practically wipe out your entire capital. To prevent this, consider trading only a fraction of your capital at a time.

If you have any questions, please feel free to ask in the comment section.