Welcome to the World of Mutual Fund Apps

Keen on boosting your investment game? Mutual funds are your golden ticket in India’s investment arena. Offering potential gains that outshine traditional savings, they’re becoming the go-to choice for wealth growth.

With a plethora of mutual fund options out there, tracking and managing your investments can be daunting. Enter mutual fund apps – your digital allies that simplify investment tracking and decision-making.

But beware, not all apps are created equal. Some shine brighter with more features and benefits, while others might pinch your pocket with higher costs or offer less functionality. We’re here to help you pick the best mutual fund app tailored to your needs.

In this guide, we’ll spotlight the top mutual fund apps for Indian investors in 2023, weighing their pros and cons, key features, and costs. By the end, you’ll have a clearer picture of your options and be ready to select the perfect app to lead you in the investment game.

Also Read: 7 Types of Mutual Funds You Could Invest In

The Best Mutual Fund Apps for Indian Investors in 2023

This year is ripe with fantastic mutual fund apps in India, all set to help you manage your investments with ease. Let’s dive into our top picks:

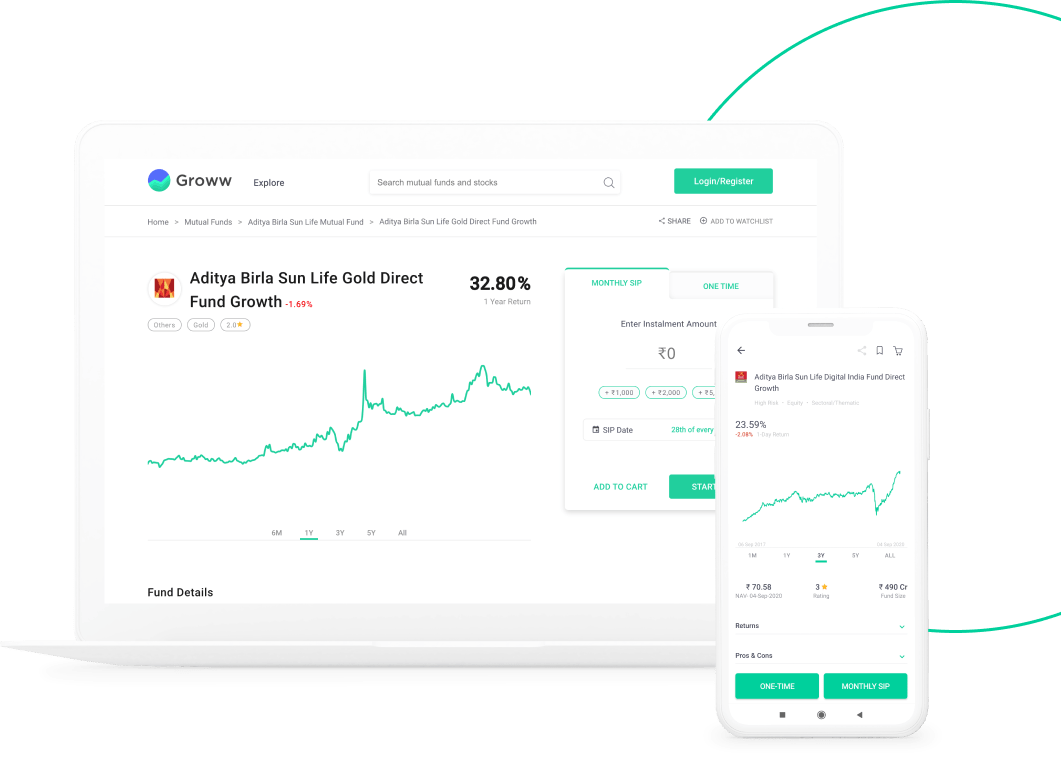

Groww

Groww is a crowd-favorite app for investing in a variety of mutual funds. It’s user-friendly with an array of features like seamless fund transfers and investment tracking.

Pros:

- No commission fees

- Intuitive user interface

- Quick fund transfers

- Diverse investment options

Cons:

- Limited research tools

- Potentially higher fund expense ratios

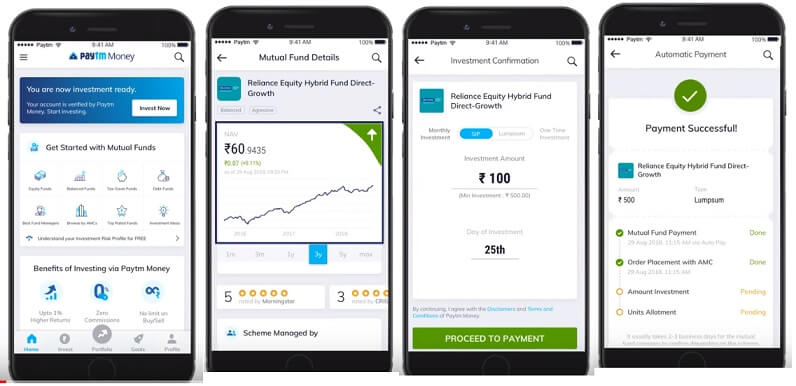

Paytm Money

Paytm Money is a well-liked app for investing in mutual funds, offering a straightforward interface and personalized investment advice, though some users find its research tools limited.

Pros:

- Commission-free

- Easy navigation

- Goal-oriented investing

- Custom investment recommendations

Cons:

- Basic research tools

- Occasional technical hiccups

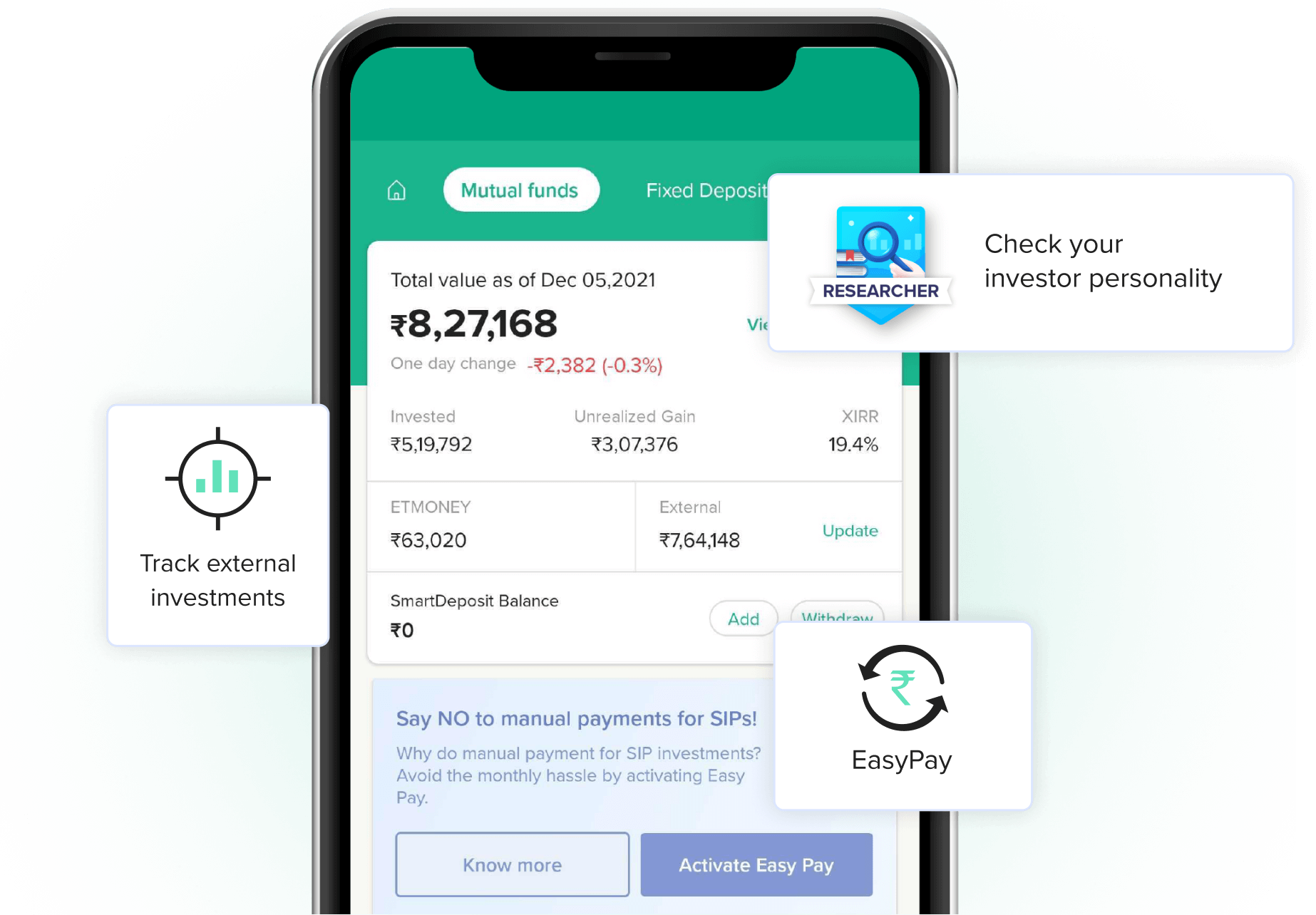

ETMoney

ETMoney goes beyond mutual funds, offering a full-fledged financial experience with stocks and gold. The app stands out with its comprehensive features and free life insurance, although some funds might carry higher expense ratios.

Pros:

- Wide-ranging financial services

- Straightforward interface

- Targeted investing

- Tailored investment advice

- Complimentary life insurance

Cons:

- Limited research options

- Some funds have steeper expense ratios

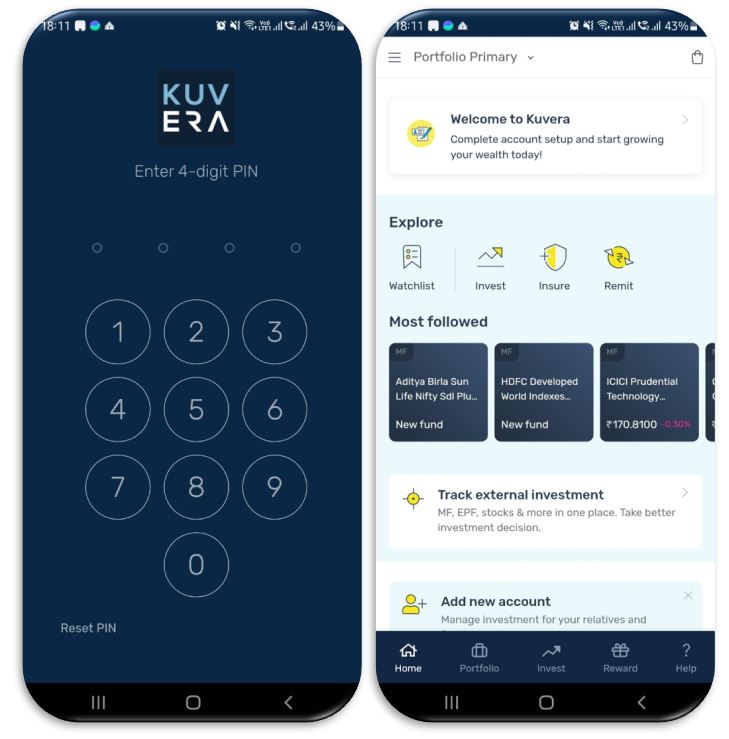

Kuvera

Kuvera offers a range of mutual funds with a user-friendly platform. It features quick transfers, efficient investment tracking, and a complimentary financial planning tool.

Pros:

- Smooth user experience

- Rapid fund transfers

- Effective investment tracking

- Free financial planner

Cons:

- More limited investment options

- Higher exit fees for some funds

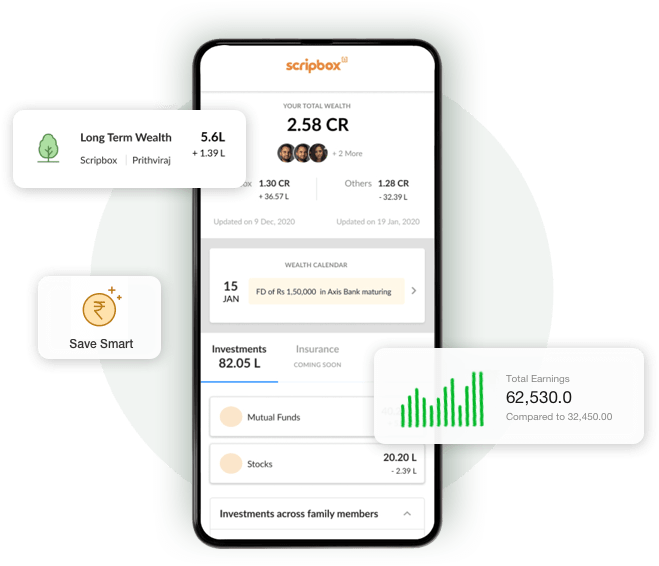

Scripbox

Scripbox specializes in offering curated mutual fund portfolios. Its features include an intuitive interface, automated portfolio balancing, and custom investment advice. Note that its fees might be higher than other apps.

Pros:

- Handpicked fund portfolios

- User-friendly design

- Automated portfolio management

- Personalized investment tips

Cons:

- Higher fee structure

- Restricted investment choices

Best Mutual Fund Apps: A Comparison

Let’s compare these leading mutual fund apps based on their features and benefits:

Range of Investments

Groww, Kuvera, Zerodha Coin, and ETMoney offer a wide variety of funds. Scripbox, however, focuses on custom portfolios, potentially limiting your choices.

User Experience

All apps provide a user-friendly interface, with Groww and Kuvera particularly standing out for their ease of use and visual appeal.

Fee Structure

Each app has a different fee policy, which can impact long-term returns. Groww, Kuvera, and Zerodha Coin are fee-free, while ETMoney and Scripbox might be pricier.

App Features

Every app comes with its unique set of features. Groww, Kuvera, and Zerodha Coin excel in automated rebalancing and tax-efficient options, while ETMoney and Scripbox offer personalized recommendations and more.

Customer Support

Groww, Kuvera, and Zerodha Coin are known for their excellent customer support. ETMoney and Scripbox also provide support, though experiences may vary.

Conclusion

Investing in mutual funds is now easier than ever, thanks to these top-notch apps. Groww, Kuvera, Zerodha Coin, ETMoney, and Scripbox each bring unique features to the table, catering to different investor needs.

As with any investment, risks are involved, and returns are not guaranteed. However, by choosing an app that aligns with your goals and understanding the market, you can set yourself up for success. Happy investing!