The world of trading is bustling with unique terminology that every beginner should grasp to fully understand the dynamics of the markets. For those starting their trading journey, it’s crucial to familiarize yourself with the most important terms, a fundamental aspect of the “Basic Terms to Learn for Aspiring Online Traders.” Traders often use specific slang and jargon, which might seem unfamiliar to newcomers. So, let’s jump in and demystify these key terms for you.

Essential Trading Terms Explained

As you step into the trading arena, you’ll frequently encounter terms like indicators, trends, range markets, bull and bear markets, stop loss, take profit, and bid and ask prices. We’ll break down each of these to enhance your understanding of the trading world, providing a solid foundation in the basic terms necessary for aspiring online traders.

- Stop Loss and Take Profit: Fundamental risk management tools in trading are stop loss and take profit orders. Set by traders, these orders automatically close an open position when the price reaches a predetermined level. Stop loss and take profit are critical for daily trading, helping traders manage risks and plan potential losses. Understanding how to use these tools effectively is essential for long-term trading success.

- Indicators: Traders frequently use indicators to analyze price charts and decipher market activity. Bulls and bears refer to traders who buy (bulls) and sell (bears) in the markets. Bulls aim to drive prices higher for profit, while bears capitalize on falling market prices.

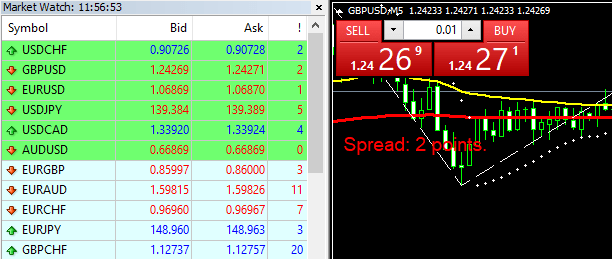

Understanding Ask and Bid Prices, and Spread

In Forex and other financial markets, every asset has two prices: the Ask price for buying and the Bid price for selling. The Ask price is what sellers are willing to accept, and the Bid price is what buyers are willing to pay. The Ask price is generally higher than the Bid price, which means market makers profit from this difference.

Market makers facilitate buying and selling of assets. The spread, the difference between Ask and Bid prices, is a primary income source for brokers, who act as intermediaries. While brokers might offer zero spreads, they often compensate by charging commissions on trading volumes. Exchanges, the venues for buying and selling assets, are now mostly electronic, replacing the traditional trading floors.

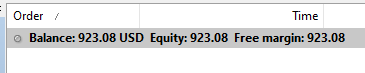

Leverage, Equity, Margin, Margin Call, and Stop-Out Levels

When Forex and stock markets were nascent, the minimum contract size was a daunting $100,000, out of reach for many average individuals. Brokers introduced leverage to enable smaller capital traders to participate. Leverage, essentially a credit extended for trading, multiplies the buying power of your account. While it can significantly increase potential profits, it also amplifies potential losses, making it a double-edged sword that must be used cautiously.

Equity represents the total value of your trading account, including the profits and losses of open positions. Margin is the portion of your account reserved for each open trading position. If your open positions start losing and your margin falls below a certain threshold, you’ll receive a margin call, prompting you to add more funds. Failure to do so leads to a stop-out, where the broker closes your positions. Proper use of stop loss orders is crucial to avoid margin calls and stop-outs, maintaining trading profitability.

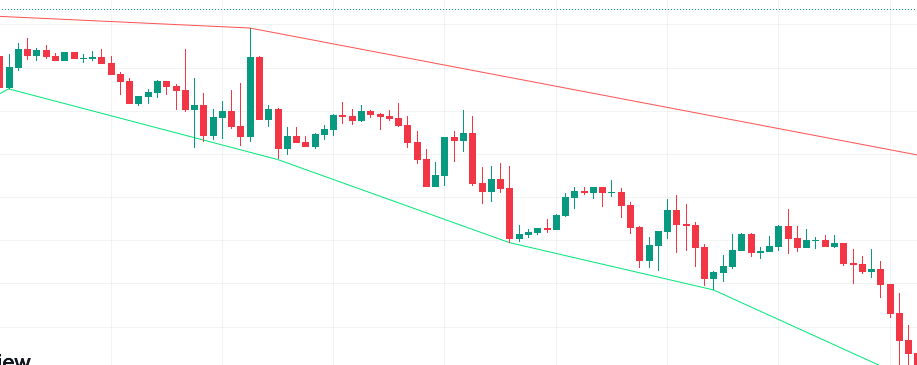

Trends, Bullish and Bearish Markets

Trends in the market refer to its movement in a specific direction over time, identified by “higher highs and lower lows.” Analyzing these trends helps traders determine whether the market is in an uptrend (rising) or a downtrend (falling). However, markets are often in a range or moving sideways, not following a clear direction. It’s estimated that markets trend only about 30% of the time, so traders need to be cautious with trend-based strategies. Uptrends are also known as bullish markets, while downtrends are referred to as bearish markets.