What is Copy Trading?

Copy trading is a method where investors automatically or manually replicate the trades of another investor. It allows traders in financial markets to mirror the positions opened and managed by a chosen investor, often within a social trading network. While not very common in India, it is popular in the US and UK. The most well-known platform for this is eToro.

Also Read: Explore: Grow Your Money with the Magic of Compounding

Understanding Copy Trading

Copy trading falls under investment management, where the account holder’s manual input is minimal. Unlike mirror trading, It involves copying specific trading strategies, creating a link between the copied investor’s account and a portion of the copying trader’s funds.

Based on the proportion of the copying trader’s allocated copy trading funds and the copied investor’s account, all trading actions that the copied investor makes are mirrored in the copying trader’s account. This includes setting Stop Loss and Take Profit orders, opening or closing positions, and more.

Is it Safe?

Think of it as similar to driving a car on the road. It can provide a better understanding of the market by replicating the actions of other traders. Research indicates that copy traders tend to be more profitable than those who trade manually. However, it may not be very helpful for individuals who are not engaged in social trading and only wish to follow successful signal providers on copy trading platforms. Confidence is key; if you copy someone’s trade without complete faith in it, you might encounter issues in the long run.

There were numerous great traders on various platforms who claimed a 99% win rate for a considerable time and attracted thousands of followers, with more than US$25 million of funds following their strategies. Unfortunately, many of them experienced a sudden and significant downfall, resulting in the loss of all their loyal followers. From a distance, copy trading might seem unsafe to newcomers or beginners in the industry.

However, going back to the driving metaphor; we don’t blame cars for accidents, do we? Copy trading can be viewed as an investment vehicle, much like buying index funds or investing in the stock market. The safety of it depends on your knowledge of the industry and the level of restraint you exercise regarding greed.

Also Read: Explore: Best Algo Trading Software for the Indian Market

Becoming a Successful Copy Trader

If you’re considering starting with copy trading, the first and most crucial step is to dedicate time to educating yourself about the fundamentals of trading. Next, understand the significance of money management and its role in executing a technical strategy effectively.

As you learn more about copy trading, you’ll discover how to analyze and evaluate the performance of signal providers, how to use leverage wisely, and how to construct a successful copy trading strategy that ensures consistent profits over time.

Copy Trading in India

While copy trading isn’t widely recognized in India, it’s gradually gaining attention. Here are two platforms through which you can start it in India:

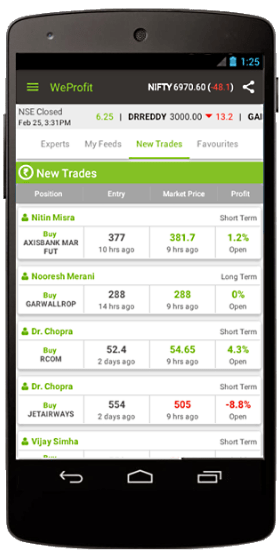

WeProfit (Discontinued)

With WeProfit, you can monitor the portfolios of expert traders and investors. They offer a free mobile app that provides notifications for each trade idea, including stop loss, target, and time frame. You have the option to copy the trades you like or review each expert’s track record, including their winning trades and profit percentages. Notable experts listed on WeProfit include Nooresh Merani and Karanam Vijay.

Open Trade is a copy trading platform from the well-known discount broker Zerodha. It features star traders from Zerodha’s client base, selected based on their past track record and profitability. Subscribing to this service provides real-time notifications when these star traders make trades, complete with all relevant details. The subscription fee depends on the trader you choose to follow.

Note: Open Trade was officially shut down in 2018

One Comment