During these pandemic times, stepping out without a facemask is risky. Yet, something even riskier exists: trading based on news.

It might look tempting to invest in stocks recommended by experts on news channels. However, this approach can quickly deplete your capital.

Unveiling TV Analysts’ Real Motives

TV analysts often recommend stocks with a hidden motive. Their goal is to generate short-term demand to benefit their PMS subscribers, offering little to no long-term value for you.

Consider this scenario:

An acclaimed stock market guru appears on a news channel, advising viewers to buy penny stock “X” and hold it for a year to potentially double their investment. The day before this broadcast, he instructs his paying subscribers to buy the same stock for a quick 10% gain over 3-5 days.

Imagine 50,000 viewers each buying 1,000 shares. This significant buying pressure will likely spike the stock price. While news viewers may feel confident holding the stock longer, PMS subscribers will likely sell as soon as they hit the 10% target.

A year later, the penny stock might become worthless due to lack of demand. In essence, the TV analyst exploits novice investors’ vulnerabilities, profiting his subscribers in the process.

This pattern is common among news-based stock recommendations. So, be wary and avoid falling for such traps.

Recommended Reading: Elevate Your Trades: The Power of Technical Analysis

The Shift in Trading Methods

Luckily, in the past decade, most people have caught onto this scam. They’re now turning to innovative trading methods like algos, quant, and machine learning.

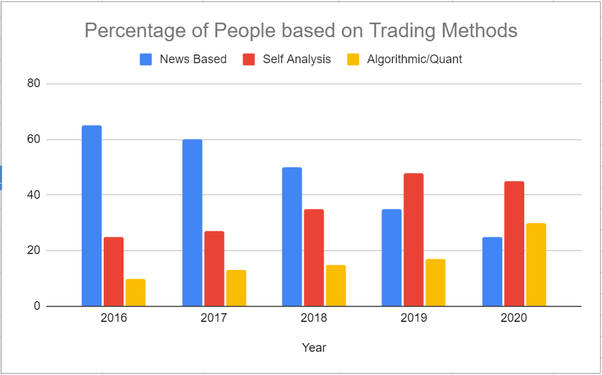

Observe the following graph, which displays five-year trends in trading methods:

Clearly, traders are increasingly favoring algorithmic trading over news-based approaches. Hopefully, in 20 years, news-based trading will decline to zero.

Until then, stay clear of news channels during trading hours. While listening to analysts is fine, base your decisions on personal research. Remember, news-based trading won’t benefit you in the long run.

One Comment