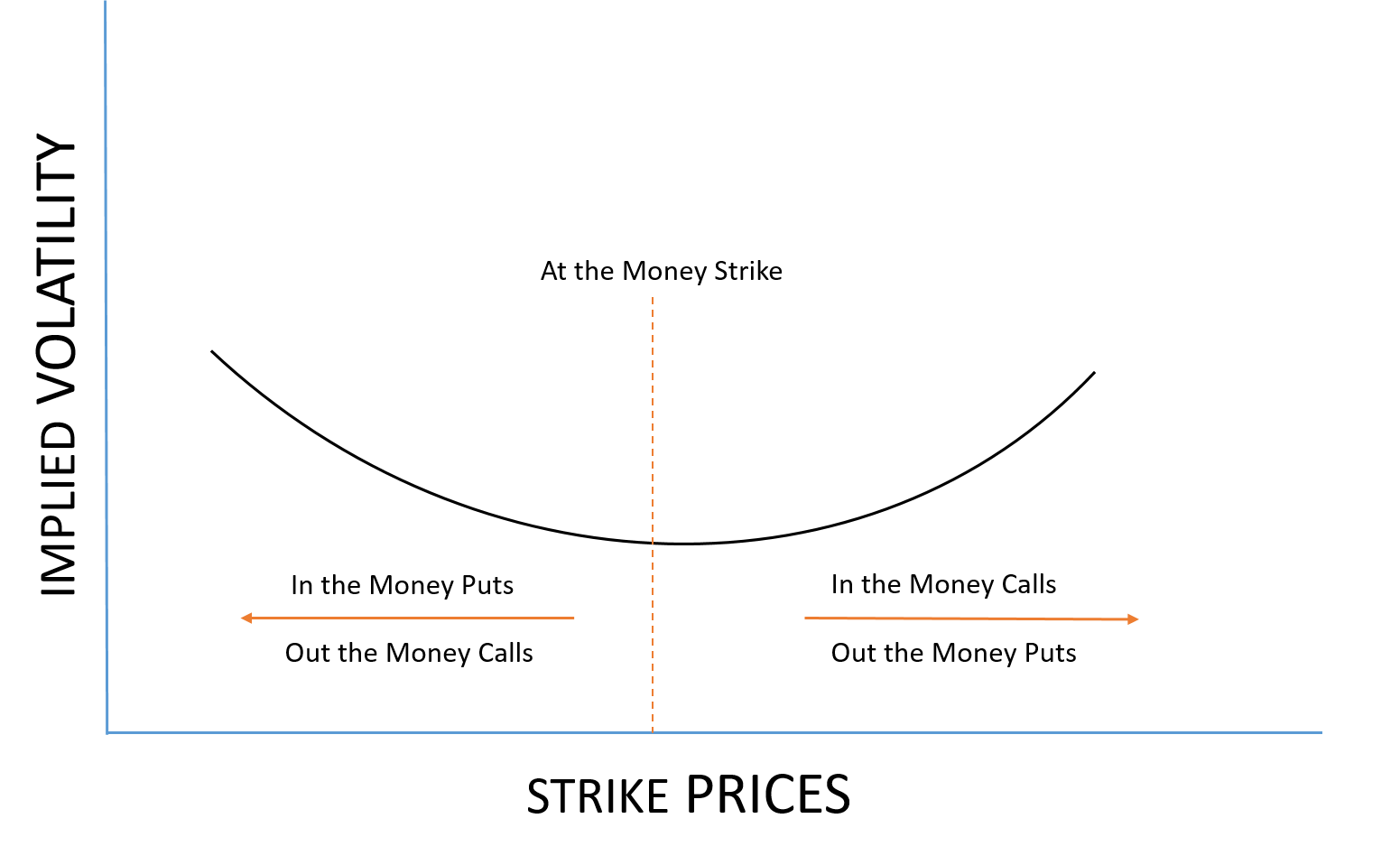

The Volatility Smile is a graphical representation of the relationship between implied volatility and the strike prices of options with the same expiration date. It gets its name from its resemblance to a smiling face. Essentially, it’s a visual pattern of implied volatility for a series of options. When plotted against the strike prices, it creates a line that slopes upward at both ends, forming a “smile.” It’s essential to note that Volatility Smiles deviate from the standard Black-Scholes theory, which typically assumes a flat volatility curve. The complexity of option pricing, compared to commodities or stocks, is well reflected in the Volatility Smile.

Causes of the Volatility Smile

The most logical explanation for the Volatility Smile is that traders tend to prefer buying or selling in-the-money and out-of-the-money options over at-the-money options. The higher demand for these options leads to increased volatility, as evident in the graph. It’s important to note, though, that this theory doesn’t apply to all option contracts, and you won’t always see a perfect smile for all options.

Utilizing the Volatility Smile for Delta Neutral Trades

It can be used for Delta Neutral trading, which means making profits regardless of the movement of the underlying stock. To capture the smile or skew, a trader can structure trades with no initial delta exposure and aim to profit from the smile. This means the trade won’t be affected by the initial upward or downward movements in the underlying asset. A common strategy involves buying one at-the-money put option and selling two out-of-the-money put options to take advantage of the significant skew in the out-of-the-money options. This strategy can also be applied to call options by reversing the structure. Another approach is selling a strangle to benefit from the market’s out-of-the-money options with significant smiles.

Does the Volatility Smile Predict Market Crashes?

Some believe that a perfectly formed curvy Volatility Smile for any option contract may indicate an impending market crash. This belief arises from the increased volatility of out-of-the-money put options, suggesting strong demand for such options. It’s worth noting that equity options traded in American markets did not exhibit a Volatility Smile before the Crash of 1987 but began showing one afterward. Some speculate that investor reassessments of fat-tail probabilities have led to higher prices for out-of-the-money options. However, there’s no solid theory to confirm this argument at present.

Explore our other option strategies at the following link:

2 Comments