Technical analysis in options trading is a powerful tool. It helps traders navigate market trends and volatility with ease. Let’s dive in.

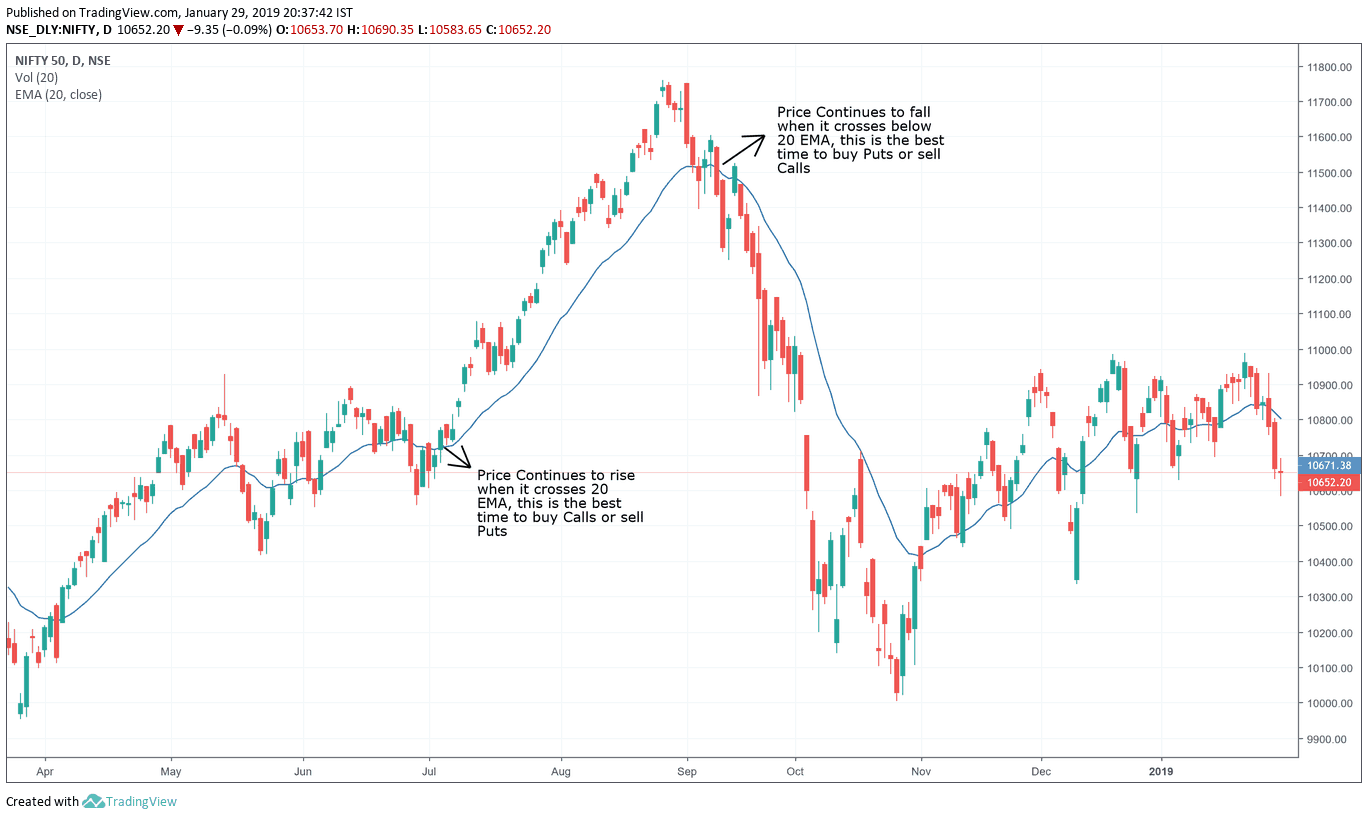

Spotting Strong Market Trends

Traders often turn to the 20-day exponential moving average (EMA). It’s a key method in options trading to spot fast movers.

Also, hitting a 90-day price peak can suggest more gains. It’s a valuable hint from technical analysis.

Also, hitting a 90-day price peak can suggest more gains. It’s a valuable hint from technical analysis.

Identifying Subtle Price Shifts

Options trading also involves watching for mild price changes. These often hint at a trend’s continuation or a rebound.

For this, the Relative Strength Index (RSI) is quite useful. It’s less complex than other tools and gives clear signals for strategic moves in options trading.

Capturing Gains from Stability

In options trading, stability can be profitable. Traders use this quiet time to benefit from premium decay, a key concept in technical analysis.

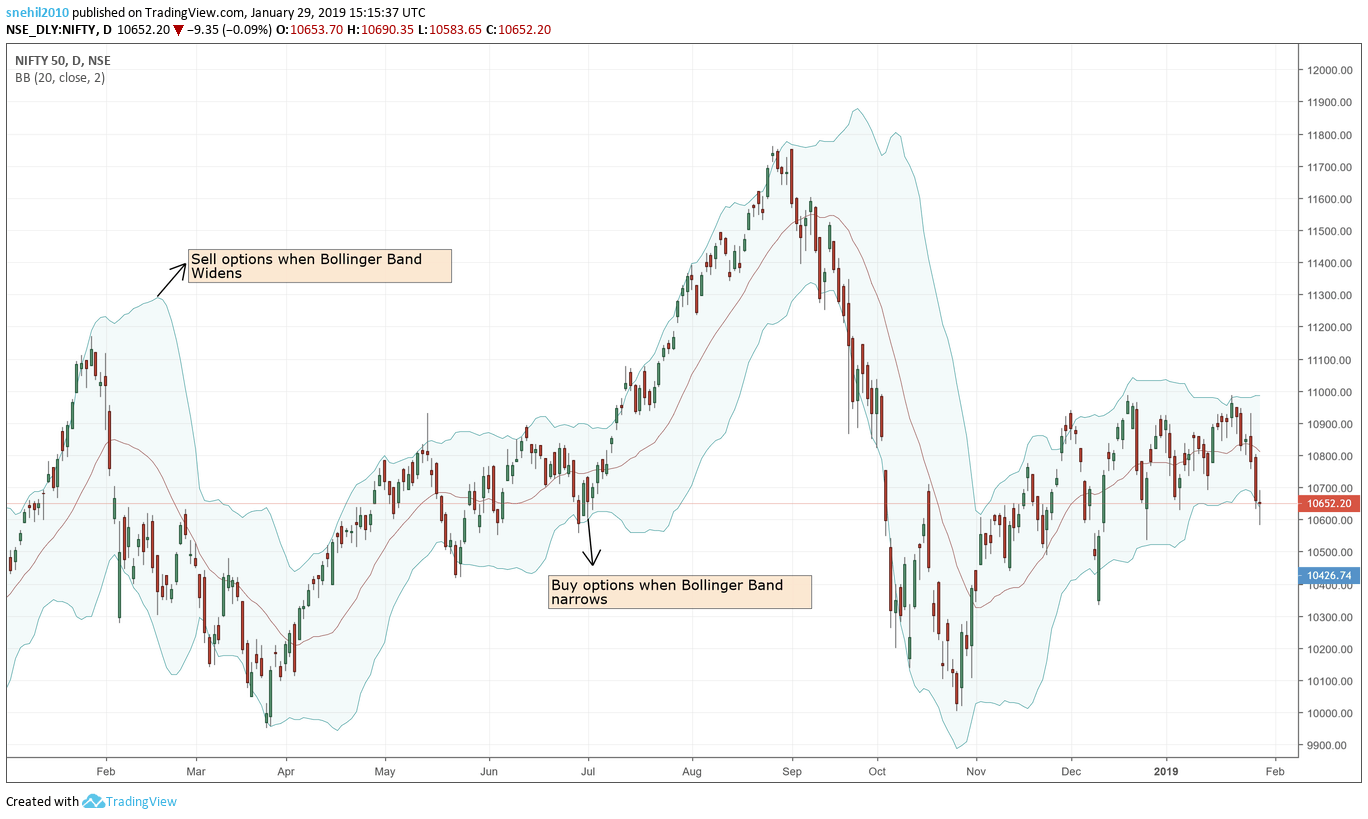

Bollinger Bands as a Trading Guide

Bollinger Bands are crucial for indicating volatility. They help traders decide when to buy or sell options, a staple technique in technical analysis.

They also serve as conservative markers for trade, supporting smart decisions in technical analysis.

They also serve as conservative markers for trade, supporting smart decisions in technical analysis.

Further Insights: Comparing Technical and Fundamental Analysis

In summary, traders have many tools at their disposal. Selecting the right one is essential for success in technical analysis and options trading. Each tool shines in different market situations, and the right choice can lead to better trading outcomes.