Tradetron is revolutionizing the world of Algo trading, making it not only accessible but also affordable for everyday traders. It boasts a marketplace brimming with strategies you can implement directly in your broker’s account. In this article, we’re exploring the top options buying strategies on Tradetron, with regular updates to keep you ahead.

If you’re just starting with Tradetron, check out this comprehensive guide to hit the ground running.

Strategy 1: Trend-Following ITM Options

Here’s a strategy that’s all about positional option buying. It focuses on purchasing monthly ITM options in Nifty, guided by basic trend-following indicators.

- Capital Required: 35,000 INR + 15,000 buffer

- Stop Loss: 10,000

- Trailing Stop Loss: Kicks in at 5,000 profit

- Target: Not set

- Monthly Fee: 10% of Gross Profit

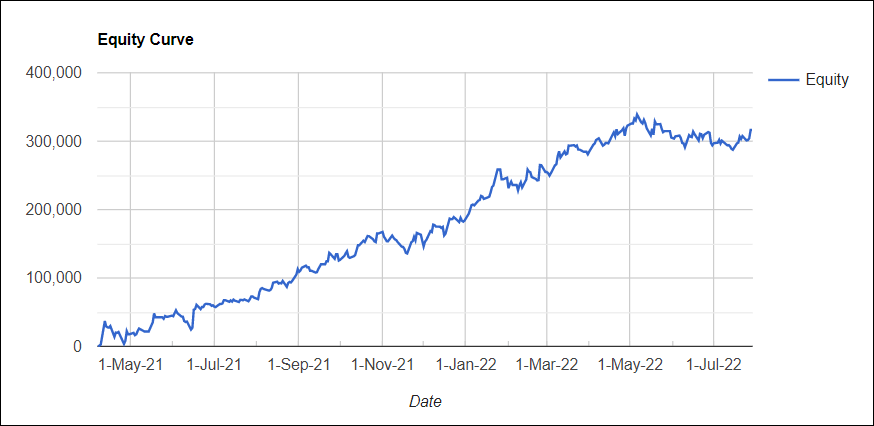

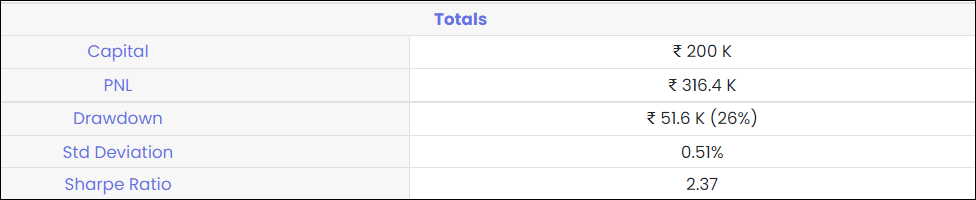

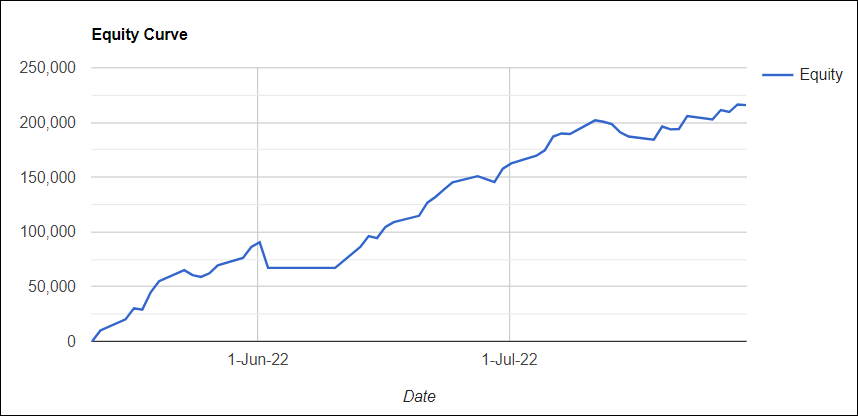

- Equity Curve:

Backtest Results:

Also, check out: The Best Options Selling Strategies in Tradetron

Strategy 2: Intraday Banknifty Weekly Options

This strategy is all about intraday trading with Banknifty weekly options. It operates based on short timeframe support and resistance, leading to up to 40 trades per day. To ensure profitability, it’s recommended to use zero brokerage plans.

- Capital Required: 50,000 INR + 50,000 buffer

- Stop Loss: 8,000

- Target: 12,000

- Monthly Fee: 15% of Gross Profit

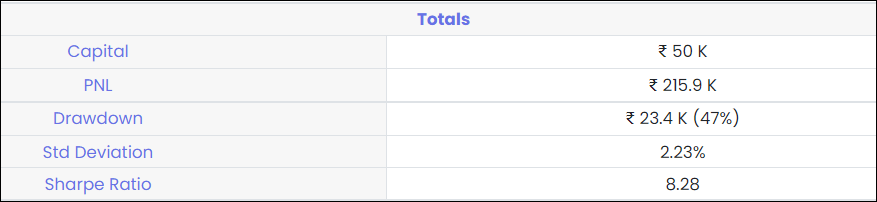

- Equity Curve:

Backtest Results:

Strategy 3: Low Capital Intraday Nifty Options

This strategy takes long positions on Nifty weekly options and is designed for intraday trading only. It follows trend-based principles and requires a lower capital investment.

- Capital Required: 10,000 INR + 10,000 Buffer

- Hard Stop Loss: 2,000

- Monthly Fee: Free

- Equity Curve:

Backtest Results:

Wrapping Up

So there you have it: the three best options buying strategies on Tradetron, in our view. The Tradetron marketplace is ripe for more long options strategies, and we’re eager to see new additions soon.

Remember, options buying might seem less likely to succeed than selling, with success rates around 30-40%. But, with lower capital requirements and a few good trades, you could see significant returns. We recommend paper trading these strategies for at least two weeks before diving in live. Keep your expectations realistic; not every trade will be a winner.

Got other strategies to share? Drop them in the comments section below.

Ready to start your Tradetron journey? Click here to begin!