The RMO (Rahul Mohindar Oscillator) is a widely used indicator for market direction. It’s particularly popular among Metastock traders for handling highly volatile instruments. In our efforts to create a robust trading system, we have designed and backtested the RMO Trading System in Amibroker. This system relies on a combination of moving averages to forecast price movements. The RMO indicator was originally developed by Mr. Rahul Mohindar, based in India. In addition to his trading and training roles, Mr. Mohindar is a panelist on both CNBC and CNN India.

If you want to learn AFL coding and create your own trading systems, click here.

RMO Trading System – AFL Overview

| Parameter | Value |

| Preferred Time-frame | Daily |

| Indicators Used | Simple Moving Average, Exponential Moving Average |

| Buy Condition |

|

| Short Condition |

|

| Sell Condition |

|

| Cover Condition |

|

| Stop Loss | 1% |

| Targets | 5% |

| Position Size | 50% of equity |

| Initial Equity | 200,000 |

| Brokerage | 100 per order |

| Margin | 10% |

RMO Trading System– AFL Code

//------------------------------------------------------

//

// Formula Name: RMO Trading System

// Website: https://zerobrokerageclub.com/

//------------------------------------------------------

_SECTION_BEGIN("RMO Trading System");

SetBarsRequired( sbrAll );

SetChartOptions(0,chartShowArrows|chartShowDates);

_N(Title = StrFormat("{{NAME}} – {{INTERVAL}} {{DATE}} Open %g, Hi %g, Lo %g, Close %g (%.1f%%) {{VALUES}}", O, H, L, C, SelectedValue( ROC( C, 1 ) ) ));

//Initial Parameters

SetTradeDelays( 1,1,1, 1 );

SetOption( "InitialEquity", 200000);

SetOption("FuturesMode" ,True);

SetOption("MinShares",1);

SetOption("CommissionMode",2);

SetOption("CommissionAmount",100);

SetOption("AccountMargin",10);

SetOption("RefreshWhenCompleted",True);

//SetPositionSize(150,spsShares);

SetPositionSize(50,spsPercentOfEquity);

SetOption( "AllowPositionShrinking", True );

Plot( Close, "Price", colorWhite, styleCandle );

SwingTrd1 = 100 * (Close - ((MA(C,2)+

MA(MA(C,2),2)+

MA(MA(MA(C,2),2),2) +

MA(MA(MA(MA(C,2),2),2),2) +

MA(MA(MA(MA(MA(C,2),2),2),2),2) +

MA(MA(MA(MA(MA(MA(C,2),2),2),2),2),2) +

MA(MA(MA(MA(MA(MA(MA(C,2),2),2),2),2),2),2)+

MA(MA(MA(MA(MA(MA(MA(MA(C,2),2),2),2),2),2),2),2)+

MA(MA(MA(MA(MA(MA(MA(MA(MA(C,2),2),2),2),2),2),2), 2),2)+

MA(MA(MA(MA(MA(MA(MA(MA(MA(MA(C,2),2),2),2),2),2), 2),2),2),2))/10))/(HHV(C,10)-LLV(C,10));

SwingTrd2=EMA(SwingTrd1,30);

SwingTrd3=EMA(SwingTrd2,30);

RMO= EMA(SwingTrd1,81);

Buy=Cross(SwingTrd2,SwingTrd3);

Short=Cross(SwingTrd3,SwingTrd2);

Sell=Short;

Cover=Buy;

BuyPrice=Open;

SellPrice=Open;

ShortPrice=Open;

CoverPrice=Open;

Buy = ExRem(Buy,Sell);

Sell = ExRem(Sell,Buy);

Short=ExRem(Short,Cover);

Cover=ExRem(Cover,Short);

StopLoss=Param("SL",1,1,10,1);

Target=Param("Target",5,5,40,5);

ApplyStop(Type=0,Mode=1,Amount=StopLoss);

ApplyStop(Type=1,Mode=1,Amount=Target);

/* Plot Buy and Sell Signal Arrows */

PlotShapes(IIf(Buy, shapeSquare, shapeNone),colorGreen, 0, L, Offset=-40);

PlotShapes(IIf(Buy, shapeSquare, shapeNone),colorLime, 0,L, Offset=-50);

PlotShapes(IIf(Buy, shapeUpArrow, shapeNone),colorWhite, 0,L, Offset=-45);

PlotShapes(IIf(Cover, shapeSquare, shapeNone),colorGreen, 0, L, Offset=-40);

PlotShapes(IIf(Cover, shapeSquare, shapeNone),colorLime, 0,L, Offset=-50);

PlotShapes(IIf(Cover, shapeUpArrow, shapeNone),colorWhite, 0,L, Offset=-45);

PlotShapes(IIf(Sell, shapeSquare, shapeNone),colorRed, 0, H, Offset=40);

PlotShapes(IIf(Sell, shapeSquare, shapeNone),colorOrange, 0,H, Offset=50);

PlotShapes(IIf(Sell, shapeDownArrow, shapeNone),colorWhite, 0,H, Offset=-45);

PlotShapes(IIf(Short, shapeSquare, shapeNone),colorRed, 0, H, Offset=40);

PlotShapes(IIf(Short, shapeSquare, shapeNone),colorOrange, 0,H, Offset=50);

PlotShapes(IIf(Short, shapeDownArrow, shapeNone),colorWhite, 0,H, Offset=-45);

_SECTION_END();

AFL Screenshot

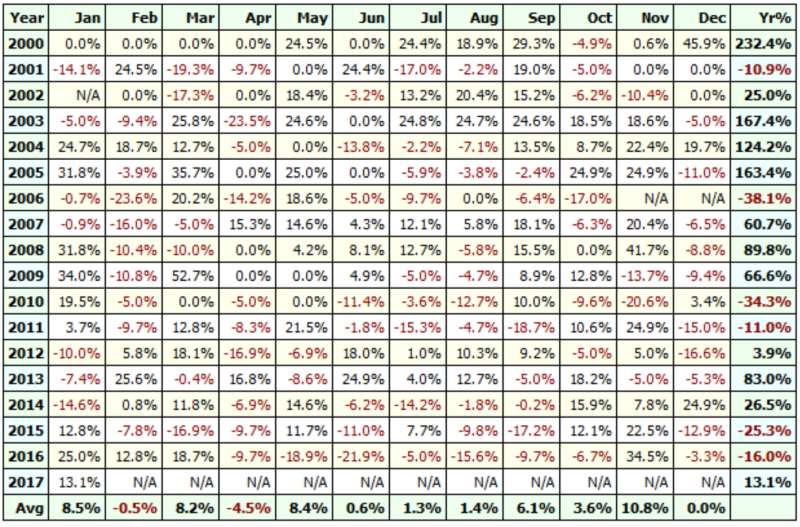

RMO Trading System- Backtest Report

The RMO Trading system has shown remarkable profitability over the last 16 years. However, it’s important to note that the system also experiences significant drawdowns. For an inexperienced trader, dealing with 11 consecutive losses and a success ratio of less than 30% can be challenging.

| Parameter | Value |

| Nifty | |

| Initial Capital | 200,000 |

| Final Capital | 36,656,201.64 |

| Scrip Name | NSE Nifty |

| Backtest Period | 30-May-2000 to 12-Jan-2017 |

| Timeframe | Daily |

| Net Profit % | 18,228.10% |

| Annual Return % | 35.78% |

| Number of Trades | 335 |

| Winning Trade % | 29.25% |

| Average Holding Period | 5.32 periods |

| Max Consecutive Losses | 11 |

| Max System % Drawdown | -70.78% |

| Max Trade % Drawdown | -39.33% |

Download the detailed backtest report here.

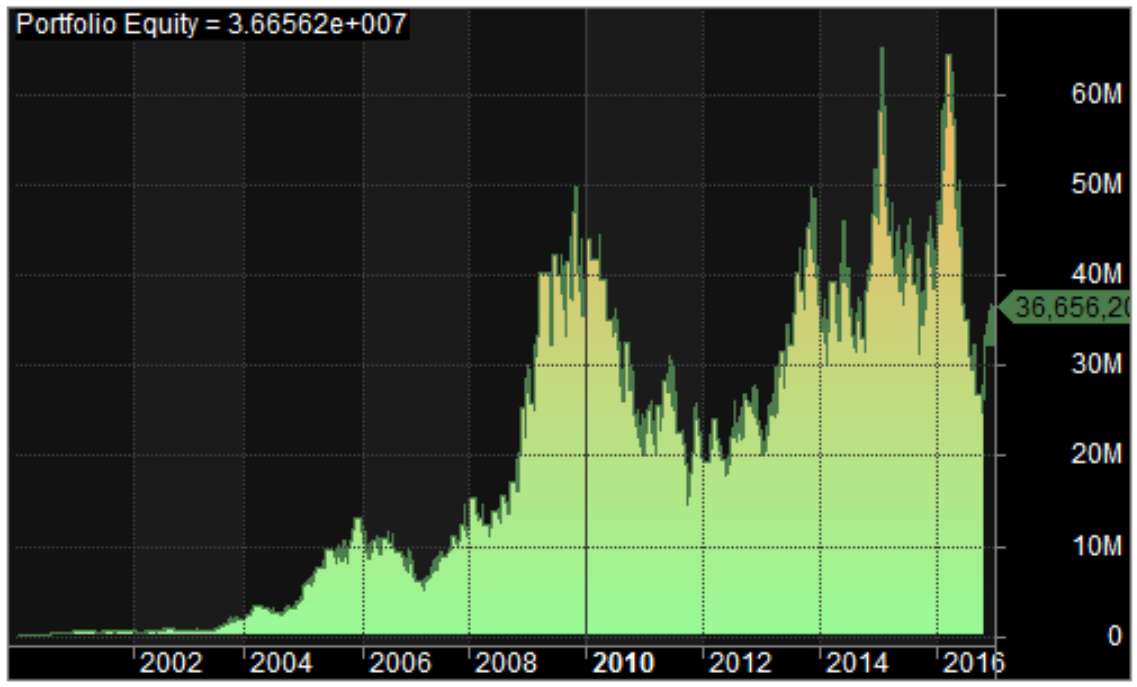

Equity Curve

The equity curve exhibits periods of significant drawdown, indicating its rough nature. Nevertheless, the system maintains overall profitability.

Profit Table

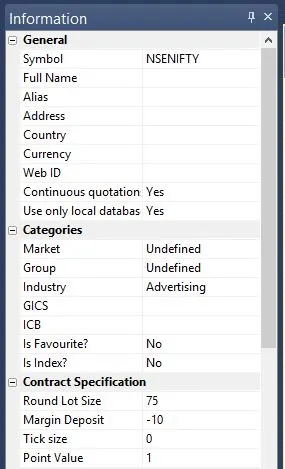

Additional Amibroker Settings for Backtesting

Go to Symbol –> Information and specify the lot size and margin requirement. The below screenshot illustrates a lot size of 75 and a margin requirement of 10% for NSE Nifty:

One Comment