Presenting an exceptional Intraday trading strategy here. This strategy leverages the RSI and ADX combination to identify Buy/Sell opportunities.

Contrary to conventional wisdom, we Buy when RSI crosses the upper limit and Sell when it crosses the lower limit. ADX serves as a trend identifier in our decision-making process. All positions are closed at the end of the day.

Explore more on AFL coding to create your personalized trading systems.

AFL Overview

| Parameter | Value |

| Preferred Timeframe | Intraday 1 minute |

| Indicators Used | RSI(17), ADX(14) |

| Buy Condition | RSI(17) >= 75 AND ADX(14) > 25 |

| Short Condition | RSI(17) <= 25 AND ADX(14) > 25 |

| Sell Condition | Same as Short Condition OR Time >= 03:15 PM |

| Cover Condition | Same as Cover Condition OR Time >= 03:15 PM |

| Stop Loss | 0.5% |

| Targets | No fixed target, Stop and reverse when AFL gives the opposite signal |

| Position Size | 150 (fixed) or 80% of equity (based on your risk appetite) |

| Initial Equity | 200,000 |

| Brokerage | 50 per order |

| Margin | 10% |

//------------------------------------------------------

//

// Formula Name: Nifty Intraday Strategy using RSI and ADX

// Website: zerobrokerageclub.com

//------------------------------------------------------

_SECTION_BEGIN("Nifty Intraday Strategy");

SetTradeDelays( 1, 1, 1, 1 );

SetOption( "InitialEquity", 200000);

SetOption("FuturesMode" ,True);

SetOption("MinShares",1);

SetOption("CommissionMode",2);

SetOption("CommissionAmount",50);

SetOption("AccountMargin",10);

SetOption("RefreshWhenCompleted",True);

SetPositionSize(150,spsShares); //Use this for fixed position size

//SetPositionSize(80,spsPercentOfEquity); //Use this for position size as a percent of Equity

SetOption( "AllowPositionShrinking", True );

BuyPrice=Open;

SellPrice=Open;

ShortPrice=Open;

CoverPrice=Open;

SetChartOptions(0,chartShowArrows|chartShowDates);

_N(Title = StrFormat("{{NAME}} – {{INTERVAL}} {{DATE}} Open %g, Hi %g, Lo %g, Close %g (%.1f%%) {{VALUES}}", O, H, L, C, SelectedValue( ROC( C, 1 ) ) ));

Plot( Close, "Price", colorWhite, styleCandle );

RSIPeriods=17;

ADXPeriods=14;

Buy=RSI(RSIPeriods)>=75 AND ADX(ADXPeriods)>25;

Short=RSI(RSIPeriods)<=25 AND ADX(ADXPeriods)>25 ;

Buy=ExRem(Buy,Short);

Short=ExRem(Short,Buy);

Sell=Short OR TimeNum()==151500;

Cover=Buy OR TimeNum()==151500;

StopLoss=0.5;

ApplyStop(Type=0,Mode=1,Amount=StopLoss);

Plot( RSI(RSIPeriods), "RSI", color=colorBlue, ParamStyle( "Style", styleOwnScale) );

Plot( ADX(ADXPeriods), "ADX", color=colorRed, ParamStyle( "Style", styleOwnScale) );

/* Plot Buy and Sell Signal Arrows */

PlotShapes(IIf(Buy, shapeSquare, shapeNone),colorGreen, 0, L, Offset=-40);

PlotShapes(IIf(Buy, shapeSquare, shapeNone),colorLime, 0,L, Offset=-50);

PlotShapes(IIf(Buy, shapeUpArrow, shapeNone),colorWhite, 0,L, Offset=-45);

PlotShapes(IIf(Cover, shapeSquare, shapeNone),colorGreen, 0, L, Offset=-40);

PlotShapes(IIf(Cover, shapeSquare, shapeNone),colorLime, 0,L, Offset=-50);

PlotShapes(IIf(Cover, shapeUpArrow, shapeNone),colorWhite, 0,L, Offset=-45);

PlotShapes(IIf(Sell, shapeSquare, shapeNone),colorRed, 0, H, Offset=40);

PlotShapes(IIf(Sell, shapeSquare, shapeNone),colorOrange, 0,H, Offset=50);

PlotShapes(IIf(Sell, shapeDownArrow, shapeNone),colorWhite, 0,H, Offset=-45);

PlotShapes(IIf(Short, shapeSquare, shapeNone),colorRed, 0, H, Offset=40);

PlotShapes(IIf(Short, shapeSquare, shapeNone),colorOrange, 0,H, Offset=50);

PlotShapes(IIf(Short, shapeDownArrow, shapeNone),colorWhite, 0,H, Offset=-45);

_SECTION_END();

AFL Screenshot

Backtest Report

Below is the backtest report for two different variations of this strategy. One employs a fixed position size of 150, while the other adjusts position size as a percentage of Equity. Notably, the second one outperforms the first, illustrating The Magic of Compounding.

Can you calculate the Final capital for the second one? Give it a try!

Moral of the Story: Profitable strategies need not be complex or lengthy.

| Parameter | Value | |

| Fixed Position Size | Position Size = 80% of Equity | |

| Initial Capital | 200,000 | 200,000 |

| Final Capital | 1,439,280.45 | 11,219,716,562.40 |

| Backtest Period | 01-Jan-2008 to 22-03-2016 | 01-Jan-2008 to 22-03-2016 |

| Timeframe | 1 Minute | 1 Minute |

| Net Profit % | 619.64% | 5,609,758.28% |

| Annual Return % | 27.10% | 277.59% |

| Number of Trades | 1,913 | 1,913 |

| Winning Trade % | 43.49% | 43.49% |

| Average Holding Period | 128.08 periods | 128.08 periods |

| Max Consecutive Losses | 12 | 12 |

| Max System % Drawdown | -18.14% | -31.51% |

| Max Trade % Drawdown | -31.51% | -44.43% |

Download the detailed backtest report here.

Equity Curve

This strategy boasts a smooth and linear equity curve with minimal drawdowns. Take a look.

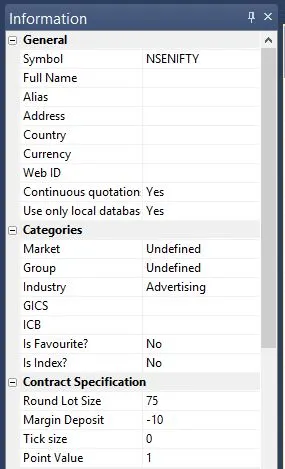

Additional Amibroker settings for backtesting

Visit Symbol–>Information to specify the lot size and margin requirement. The screenshot below illustrates a lot size of 75 and a margin requirement of 10% for NSE Nifty:

One Comment