In response to our readers’ requests, we’ve crafted a straightforward strategy for trading Crude Oil futures on MCX. This strategy is a swing trading approach that follows trends, focusing on daily timeframes. It utilizes the Bollinger Bands indicator to identify trend breakouts. While this strategy generates a low number of trades, making it user-friendly, it does come with a slightly higher maximum drawdown. Therefore, proper risk management is essential. Designed with beginners in commodity markets in mind, this Crude Oil Trading Strategy offers an overview and AFL code details.

Explore here to learn AFL coding and create your own trading systems.

AFL Overview

| Parameter | Value |

| Preferred Timeframe | Daily |

| Indicators Used | Bollinger Band |

| Buy Condition | If the closing price of the day exceeds the upper band of the Bollinger Band. |

| Short Condition | If the closing price of the day falls below the lower band of the Bollinger Band. |

| Sell Condition | Same as the Short Condition. |

| Cover Condition | Same as the Buy Condition. |

| Stop Loss | 1% |

| Targets | No fixed target |

| Position Size | 50% of initial equity |

| Initial Equity | 200,000 |

| Brokerage | 100 per order |

| Margin | 20% |

AFL Code

//------------------------------------------------------

//

// Formula Name: Crude Oil Trading Startegy

// Website: zerobrokerageclub.com

//------------------------------------------------------

_SECTION_BEGIN("Crude Oil Trading Startegy");

SetChartOptions(0,chartShowArrows|chartShowDates);

_N(Title = StrFormat("{{NAME}} – {{INTERVAL}} {{DATE}} Open %g, Hi %g, Lo %g, Close %g (%.1f%%) {{VALUES}}", O, H, L, C, SelectedValue( ROC( C, 1 ) ) ));

//Initial Parameters

SetTradeDelays( 1, 1, 1, 1 );

SetOption( "InitialEquity", 200000);

SetOption("FuturesMode" ,True);

SetOption("MinShares",1);

SetOption("CommissionMode",2);

SetOption("CommissionAmount",100);

SetOption("AccountMargin",10);

SetOption("RefreshWhenCompleted",True);

SetPositionSize(50,spsPercentOfEquity);

SetOption( "AllowPositionShrinking", True );

BuyPrice=Open;

SellPrice=Open;

ShortPrice=Open;

CoverPrice=Open;

Plot( Close, "Price", colorWhite, styleCandle );

Periods = param("Periods", 40, 5, 100, 5 );

Width = param("Width", 1, 1, 10, 1 );

Color = ParamColor("Color", colorLightGrey );

Style = ParamStyle("Style", styleLine | styleNoLabel ) | styleNoLabel;

Plot( bbt = BBandTop( Close, Periods, Width ), "BBTop" + _PARAM_VALUES(), Color, Style );

Plot( bbb = BBandBot( Close, Periods, Width ), "BBBot" + _PARAM_VALUES(), Color, Style );

PlotOHLC( bbt, bbt, bbb, bbb, "", ColorBlend( Color, GetChartBkColor(), 0.8 ), styleNoLabel | styleCloud | styleNoRescale, Null, Null, Null, -1 );

Buy=Close>=BBandTop( Close, Periods, Width );

Short=Close<=BBandBot( Close, Periods, Width );

Sell=Short;

Cover=Buy;

Buy = ExRem(Buy,Sell);

Sell = ExRem(Sell,Buy);

Short=ExRem(Short,Cover);

Cover=ExRem(Cover,Short);

printf("\nBuy : " + Buy );

printf("\nSell : " + Sell );

printf("\nShort : " + Short );

printf("\nCover : " + Cover );

Stoploss=Optimize("SL",1,1,5,1);

ApplyStop(Type=0,Mode=1,Amount=StopLoss);

/* Plot Buy and Sell Signal Arrows */

PlotShapes(IIf(Buy, shapeSquare, shapeNone),colorGreen, 0, L, Offset=-40);

PlotShapes(IIf(Buy, shapeSquare, shapeNone),colorLime, 0,L, Offset=-50);

PlotShapes(IIf(Buy, shapeUpArrow, shapeNone),colorWhite, 0,L, Offset=-45);

PlotShapes(IIf(Cover, shapeSquare, shapeNone),colorGreen, 0, L, Offset=-40);

PlotShapes(IIf(Cover, shapeSquare, shapeNone),colorLime, 0,L, Offset=-50);

PlotShapes(IIf(Cover, shapeUpArrow, shapeNone),colorWhite, 0,L, Offset=-45);

PlotShapes(IIf(Sell, shapeSquare, shapeNone),colorRed, 0, H, Offset=40);

PlotShapes(IIf(Sell, shapeSquare, shapeNone),colorOrange, 0,H, Offset=50);

PlotShapes(IIf(Sell, shapeDownArrow, shapeNone),colorWhite, 0,H, Offset=-45);

PlotShapes(IIf(Short, shapeSquare, shapeNone),colorRed, 0, H, Offset=40);

PlotShapes(IIf(Short, shapeSquare, shapeNone),colorOrange, 0,H, Offset=50);

PlotShapes(IIf(Short, shapeDownArrow, shapeNone),colorWhite, 0,H, Offset=-45);

PlotGrid(0, colorLightGrey);

PlotGrid(25, colorLightGrey);

PlotGrid(-25, colorLightGrey);

_SECTION_END();

AFL Screenshot

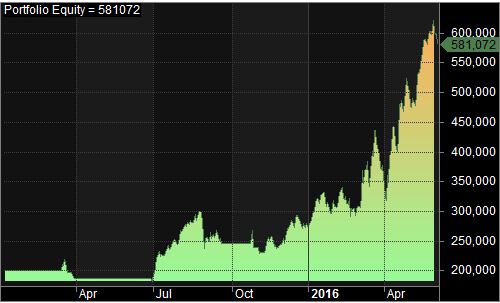

Backtest Report

| Parameter | Value |

| Fixed Position Size | |

| Initial Capital | 200,000 |

| Final Capital | 581,072 |

| Scrip Name | MCX Crude Oil Futures |

| Backtest Period | 16-Mar-2015 to 03-June-2016 |

| Timeframe | Daily |

| Net Profit % | 190.54% |

| Annual Return % | 111.72% |

| Number of Trades | 8 |

| Winning Trade % | 37.50% |

| Average Holding Period | 27.50 periods |

| Max Consecutive Losses | 3 |

| Max System % Drawdown | -26.97% |

| Max Trade % Drawdown | -42.07% |

This Crude Oil Trading strategy exhibits slightly higher drawdown figures. Nevertheless, it remains profitable over the long term. Access the comprehensive backtest report here.

Equity Curve

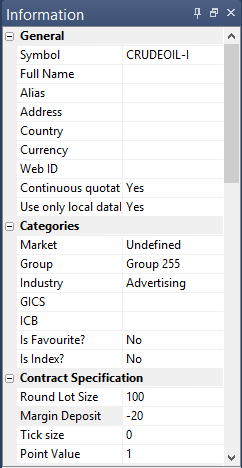

Additional Amibroker settings for backtesting

Go to Symbol–>Information and specify the lot size and margin requirement. The screenshot below illustrates a lot size of 100 and a margin requirement of 20% for Crude Oil Futures:

2 Comments