Unlocking Stock Market Trends with CCI Trading System

The Commodity Channel Index (CCI) is a powerful tool for spotting overbought or oversold market conditions. Created by the ingenious mind of Donald Lambert in 1980, the CCI was initially designed for commodities but has since been adapted for stocks and futures. It’s a brilliant way to gauge market conditions.

CCI’s approach is straightforward. It compares the current price to the average price over a specific period. If the current price is higher than the average, CCI shouts “Overbought!” If it’s lower, it signals “Oversold!” The CCI scale swings between two extremes, making it valuable for Mean Reversion Trading. But wait, there’s more – CCI divergence can also help identify trends.

CCI Trading System Demystified

We present to you a simplified CCI Trading System. What’s truly remarkable is that this system consistently delivers impressive results, especially when tested on daily charts.

If you’re interested in coding your trading systems using Amibroker Formula Language (AFL), check out our AFL learning resources.

Key Features of the CCI Trading System

| Parameter | Value |

| Preferred Timeframe | Daily |

| Indicators Used | CCI (Commodity Channel Index) |

| Buy Conditions |

|

| Short Conditions |

|

| Sell Conditions |

|

| Cover Conditions |

|

| Stop Loss | 2% |

| Targets | 5% |

| Position Size | 150 (fixed) |

| Initial Equity | 200,000 |

| Brokerage | 100 per order |

| Margin | 10% |

CCI Trading System– AFL Code

//------------------------------------------------------

//

// Formula Name: CCI Trading system

// Website: https://zerobrokerageclub.com/

//------------------------------------------------------

_SECTION_BEGIN("CCI Trading System");

SetBarsRequired( sbrAll );

SetChartOptions(0,chartShowArrows|chartShowDates);

_N(Title = StrFormat("{{NAME}} – {{INTERVAL}} {{DATE}} Open %g, Hi %g, Lo %g, Close %g (%.1f%%) {{VALUES}}", O, H, L, C, SelectedValue( ROC( C, 1 ) ) ));

//Initial Parameters

SetTradeDelays( 1,1,1, 1 );

SetOption( "InitialEquity", 200000);

SetOption("FuturesMode" ,True);

SetOption("MinShares",1);

SetOption("CommissionMode",2);

SetOption("CommissionAmount",100);

SetOption("AccountMargin",10);

SetOption("RefreshWhenCompleted",True);

SetPositionSize(150,spsShares);

SetOption( "AllowPositionShrinking", True );

Plot( Close, "Price",colorWhite, styleCandle );

CCISlow=Param("CCISlow",30,30,100,10);

CCIFast=Param("CCIFast",10,5,30,5);

Buy = Cross( CCI(CCIFast), 0 ) AND CCI(CCIFast) > CCI(CCISlow) ;

Short = Cross( 0,CCI(CCIFast)) AND CCI(CCIFast) < CCI(CCISlow);

Sell=Short;

Cover=Buy;

BuyPrice=Open;

SellPrice=Open;

ShortPrice=Open;

CoverPrice=Open;

Buy = ExRem(Buy,Sell);

Sell = ExRem(Sell,Buy);

Short=ExRem(Short,Cover);

Cover=ExRem(Cover,Short);

printf("\nBuy : " + Buy );

printf("\nSell : " + Sell );

printf("\nShort : " + Short );

printf("\nCover : " + Cover );

StopLoss=Param("SL",2,1,10,1);

Target=Param("Target",5,5,40,5);

ApplyStop(Type=0,Mode=1,Amount=StopLoss);

ApplyStop(Type=1,Mode=1,Amount=Target);

PlotShapes(IIf(Buy, shapeSquare, shapeNone),colorGreen, 0, L, Offset=-40);

PlotShapes(IIf(Buy, shapeSquare, shapeNone),colorLime, 0,L, Offset=-50);

PlotShapes(IIf(Buy, shapeUpArrow, shapeNone),colorWhite, 0,L, Offset=-45);

PlotShapes(IIf(Cover, shapeSquare, shapeNone),colorGreen, 0, L, Offset=-40);

PlotShapes(IIf(Cover, shapeSquare, shapeNone),colorLime, 0,L, Offset=-50);

PlotShapes(IIf(Cover, shapeUpArrow, shapeNone),colorWhite, 0,L, Offset=-45);

PlotShapes(IIf(Sell, shapeSquare, shapeNone),colorRed, 0, H, Offset=40);

PlotShapes(IIf(Sell, shapeSquare, shapeNone),colorOrange, 0,H, Offset=50);

PlotShapes(IIf(Sell, shapeDownArrow, shapeNone),colorWhite, 0,H, Offset=-45);

PlotShapes(IIf(Short, shapeSquare, shapeNone),colorRed, 0, H, Offset=40);

PlotShapes(IIf(Short, shapeSquare, shapeNone),colorOrange, 0,H, Offset=50);

PlotShapes(IIf(Short, shapeDownArrow, shapeNone),colorWhite, 0,H, Offset=-45);

_SECTION_END();

How to Use the CCI Trading System?

Step 1: Copy the AFL code provided and set it up in your local Amibroker software.

Step 2: Download and set up End-of-Day (EOD) data for your preferred stock exchange.

Step 3: In the Amibroker software, go to the “Analysis” menu and select “Explore.” In the “Range” dropdown, choose “1 recent bar.”

Step 4: In the results, you’ll see the Trend score for each script. A trend score above 5 indicates bullish stocks, while a score below 2 points to bearish stocks.

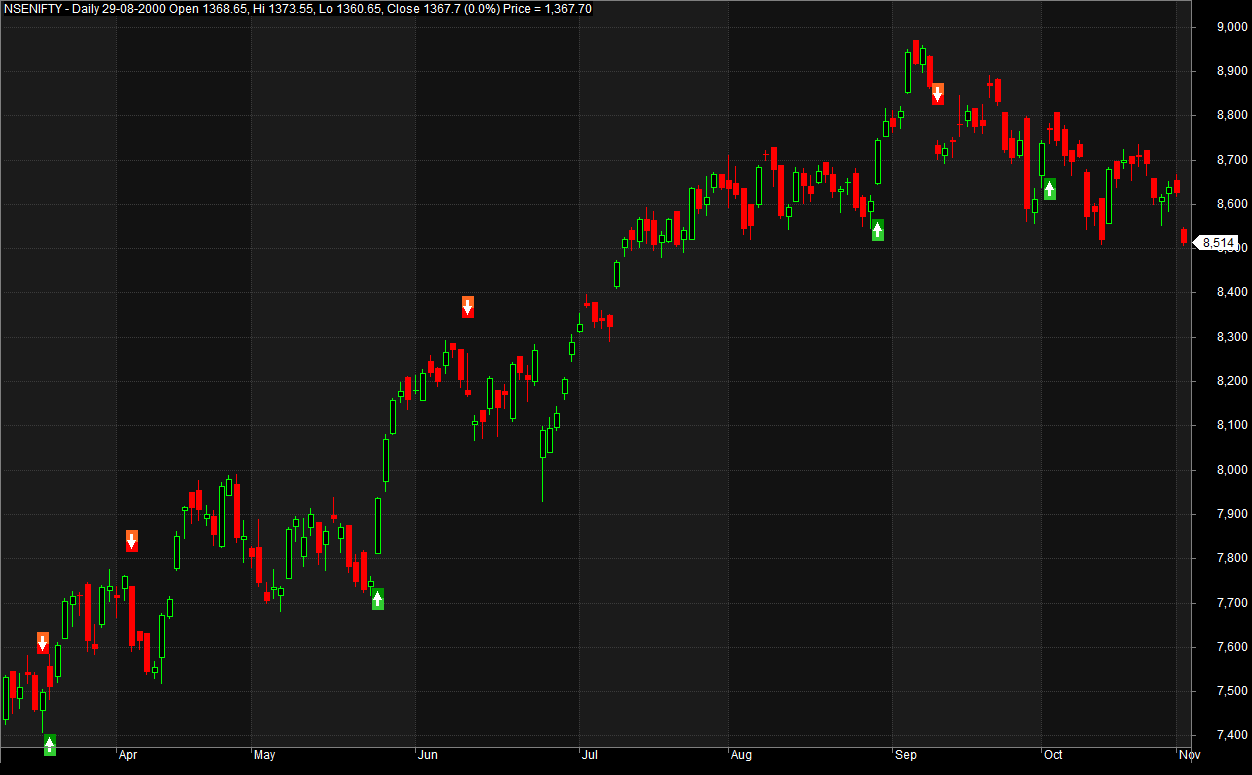

AFL Screenshot

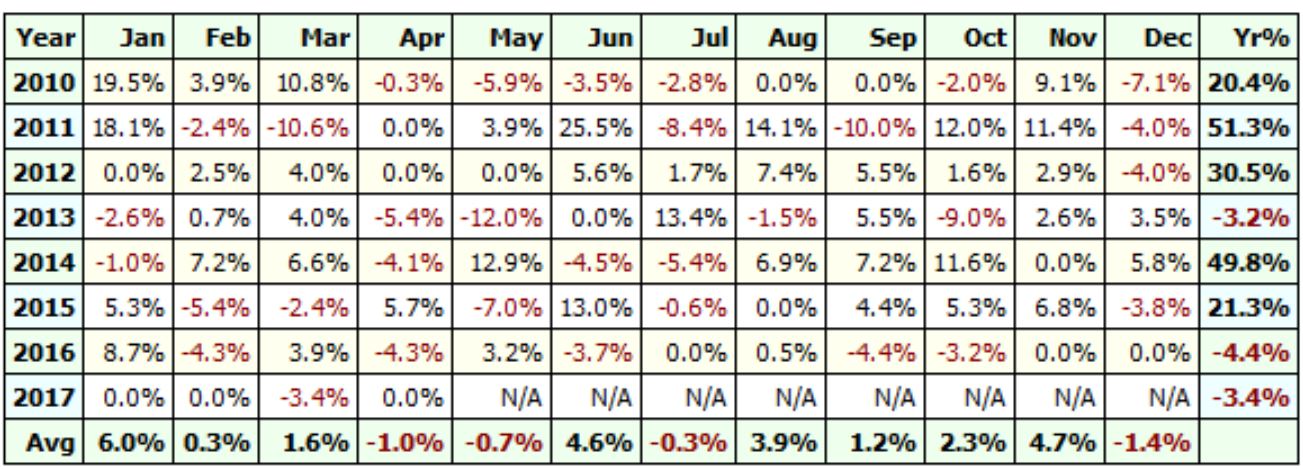

Unlock the CCI Trading System’s Potential – Backtest Report

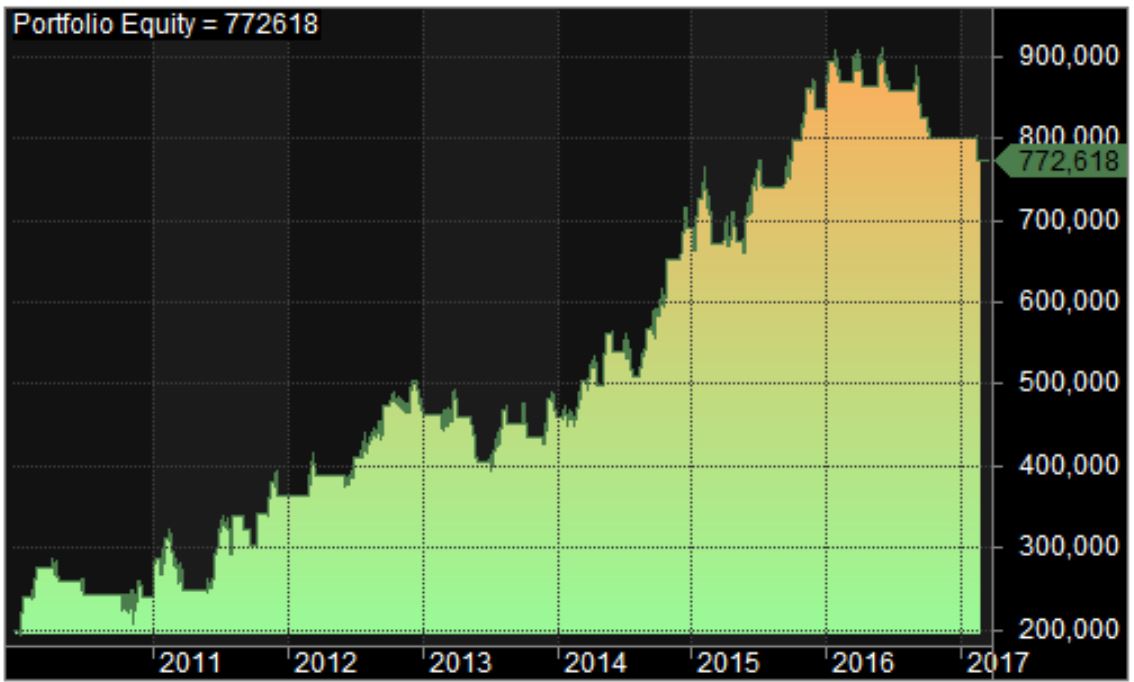

The CCI Trading System consistently delivers excellent results. With a modest drawdown rate, it’s well-suited for mildly aggressive traders. Achieving a 20% Compound Annual Growth Rate (CAGR) over the last six years bodes well for long-term capital growth.

| Parameter | Value |

| Nifty | |

| Initial Capital | 200,000 |

| Final Capital | 772,617.80 |

| Scrip Name | NSE Nifty |

| Backtest Period | 01-Jan-2010 to 24-Apr-2017 |

| Timeframe | Daily |

| Net Profit % | 286.31% |

| Annual Return % | 20.32% |

| Number of Trades | 99 |

| Winning Trade % | 42.42% |

| Average Holding Period | 7.88 periods |

| Max Consecutive Losses | 6 |

| Max System % Drawdown | -27.43% |

| Max Trade % Drawdown | -37.62% |

Download the detailed backtest report here.

The equity curve, smoother than most trading systems we’ve seen, experiences periods of mild drawdown, which are par for the course for any system.

Equity Curve

Profit Table

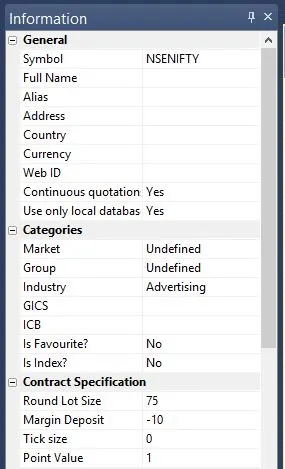

Optimizing Amibroker Settings for Backtesting

Head to “Symbol” –> “Information” and specify the lot size and margin requirement. The screenshot below shows a lot size of 75 and a margin requirement of 10% for NSE Nifty: