Enhance Your Stock Analysis with the CPR Spreadsheet

This article delves into the Central Pivot Range (CPR) spreadsheet, a transformative tool for calculating CPR and support-resistance levels of stock symbols. Developed on Google Sheets, this automated tool seamlessly integrates with Google Finance to provide real-time data. Discover its features and how you can access it at no cost.

Deep Dive into CPR

The Central Pivot Range (CPR) stands out as a highly accurate indicator for predicting stock prices. It’s an essential tool for traders.

To gain a deep understanding of CPR, including its calculation, applications, and interpretation, visit the following link:

Comprehensive Guide on the CPR Indicator

Inside the CPR Spreadsheet

The CPR spreadsheet consists of three informative sections:

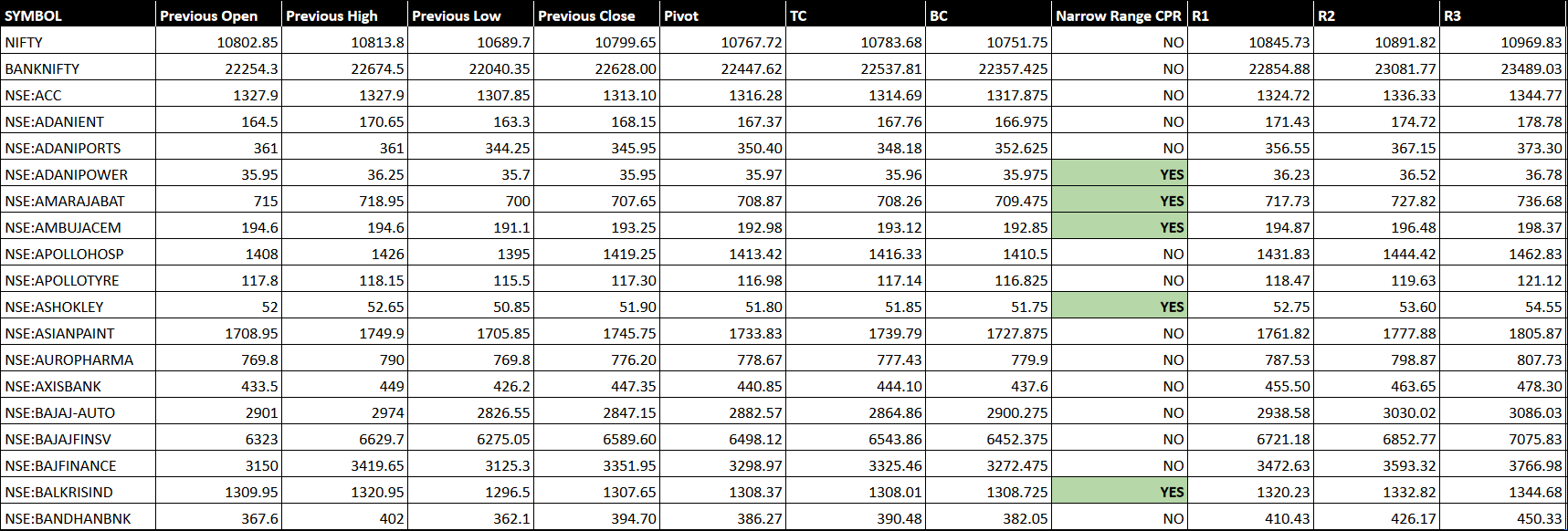

CPR Analysis for F&O Stocks

This section presents the CPR levels for all F&O listed stocks from NSE, encompassing:

- Pivot

- Top Central (TC)

- Bottom Central (BC)

- Resistance Levels (R1 to R4)

- Support Levels (S1 to S4)

The levels, calculated daily for Intraday trading, use the previous day’s OHLC values, updating automatically based on Google Finance data.

The levels, calculated daily for Intraday trading, use the previous day’s OHLC values, updating automatically based on Google Finance data.

A special feature, the “Narrow Range CPR” column, signals narrow CPR widths indicating possible trending markets. This is marked when the difference between TC and BC is smaller than 0.2% of the closing price.

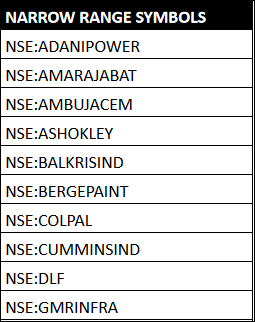

Identifying Narrow Range Symbols

The Narrow Range Symbols tab offers a filtered list of symbols with narrow range CPR, extracted from the first section.

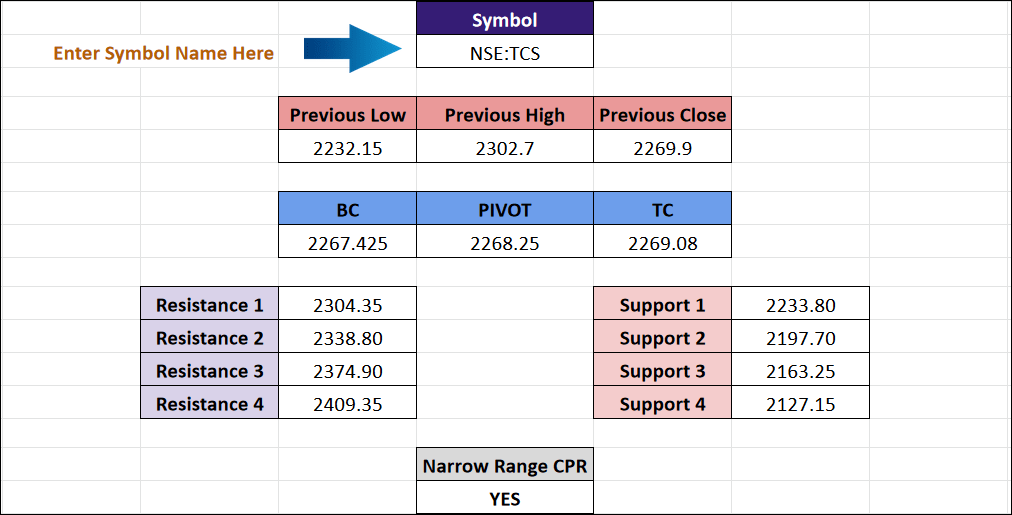

Custom CPR Analysis for Any Stock

For stocks not included in the first section, this part allows calculation of CPR levels for any financial instrument listed on Google Finance.

Enter the symbol in cell G6, and the spreadsheet calculates CPR levels automatically.

Use the format “Stock Exchange Name:Symbol” for entry. For instance, the default “NSE:TCS” resets to default when the spreadsheet is refreshed or reopened.

Use the format “Stock Exchange Name:Symbol” for entry. For instance, the default “NSE:TCS” resets to default when the spreadsheet is refreshed or reopened.

Applying CPR Spreadsheet in Trading

Leverage the CPR spreadsheet in various ways to enhance your trading strategies:

- Utilize narrow range CPR for predicting market trends

- Apply CPR level breakouts for informed Buy/Sell positions

- Use support/resistance levels for effective stop-loss planning

For detailed strategies and CPR level usage, refer to this in-depth guide.

An active internet connection is necessary to use this tool effectively.

Access the CPR Spreadsheet for Free

Get immediate access to this valuable sheet by entering your email below. You can also access it directly via this link.

2 Comments