Amibroker vs Tradetron: The Ultimate Showdown

Amibroker and Tradetron stand out as popular choices for algorithmic trading enthusiasts worldwide. Both platforms are ideal for developing, testing, and executing trading strategies. This guide compares Amibroker vs Tradetron on various aspects, assisting you in selecting the right platform for your trading adventures.

Comparing Amibroker and Tradetron – What You Need to Know

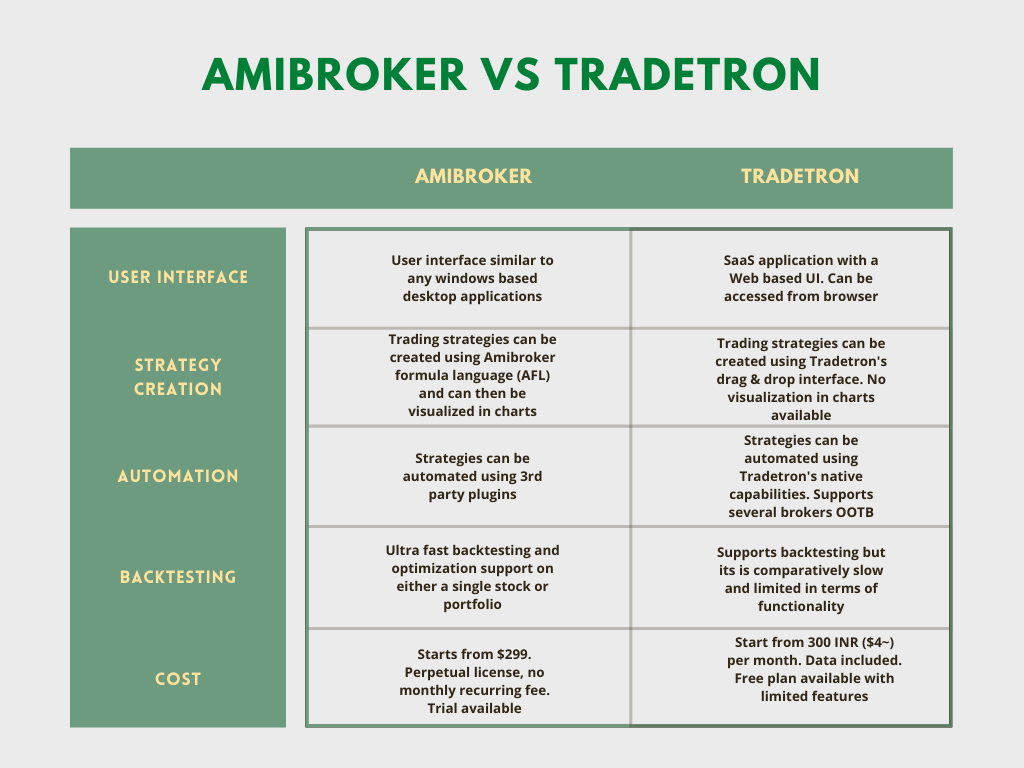

Let’s dive into a side-by-side comparison of Amibroker and Tradetron across five critical dimensions:

- User Interface

- Strategy Creation

- Automation

- Backtesting

- Cost

While both tools serve unique purposes, this comparison sheds light on their distinct and overlapping features. Check out the detailed comparison table below:

Exploring User Interfaces

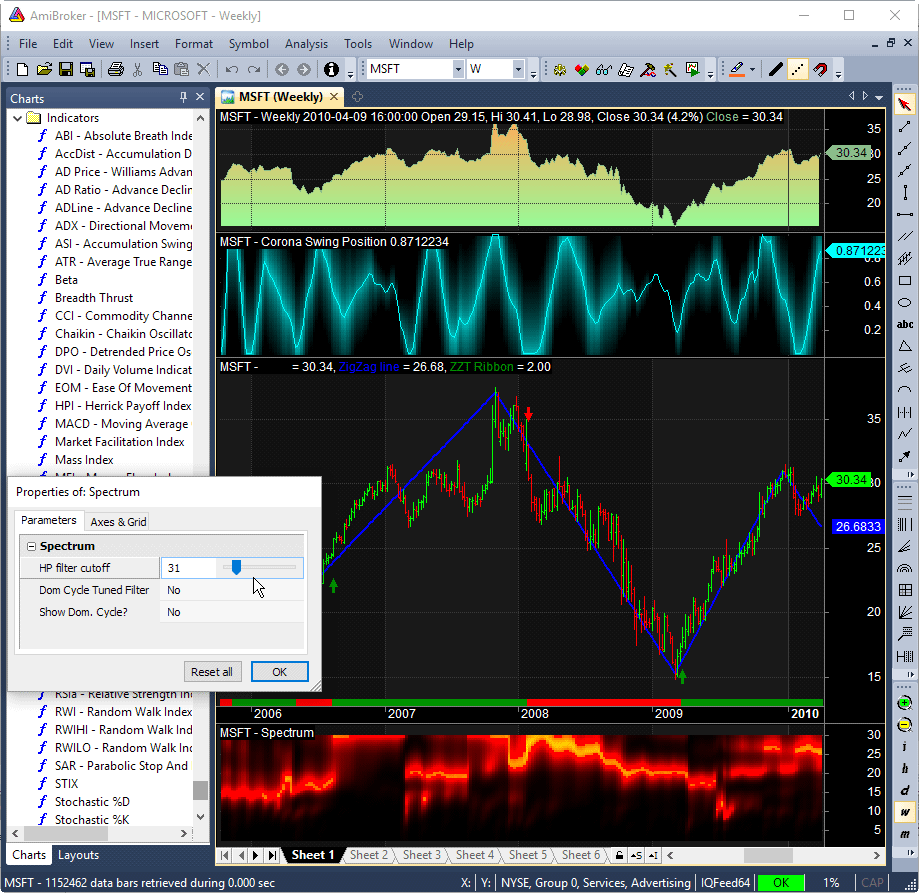

Amibroker is a desktop application for Windows, offering a familiar desktop software experience with menu-driven features.

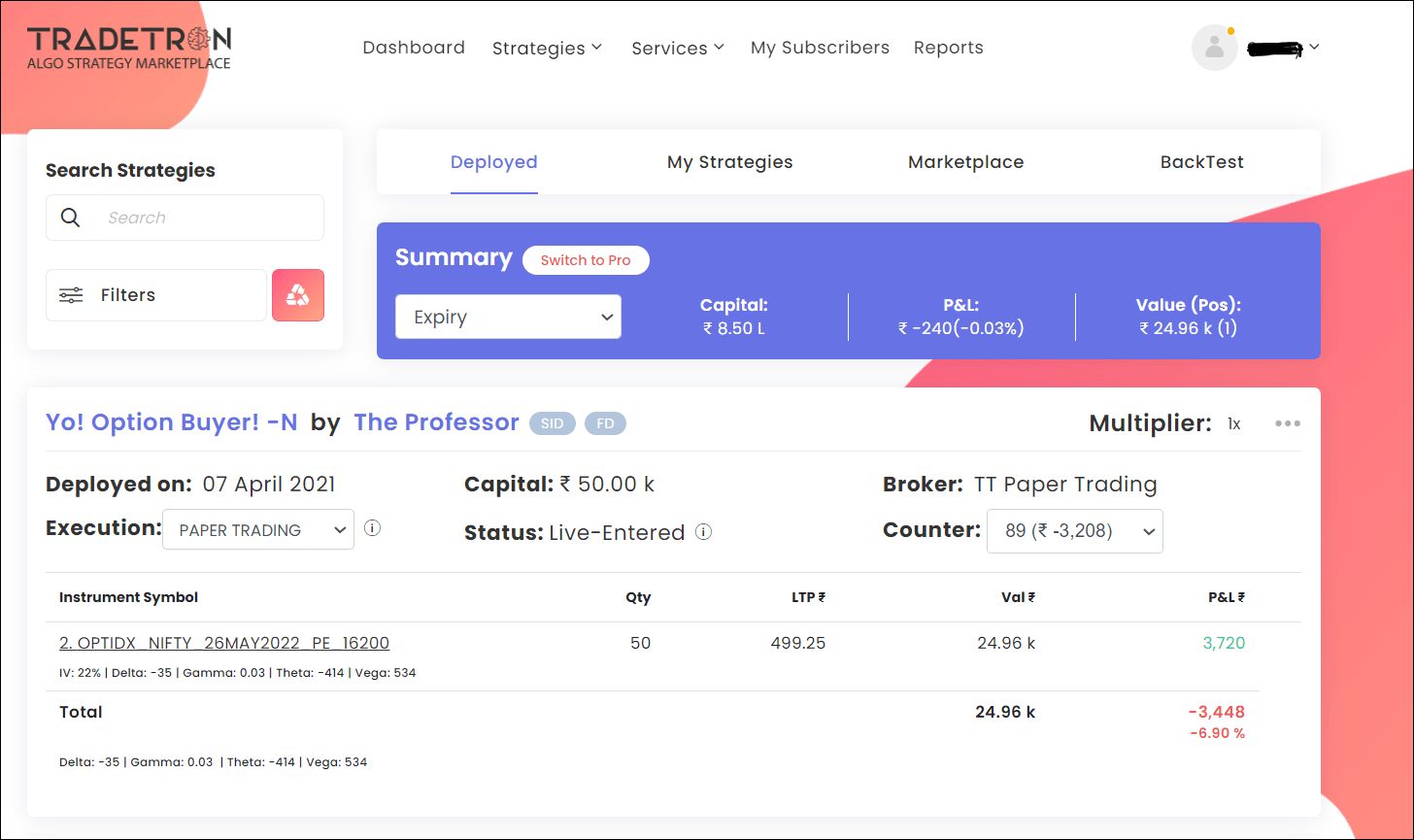

Conversely, Tradetron is a browser-based tool, accessible from any operating system. It features an intuitive, lightweight web interface with drag-and-drop capabilities. Access Tradetron from [eafl id=”229867″ name=”Tradetron” text=”this link”].

Strategy Creation Made Easy

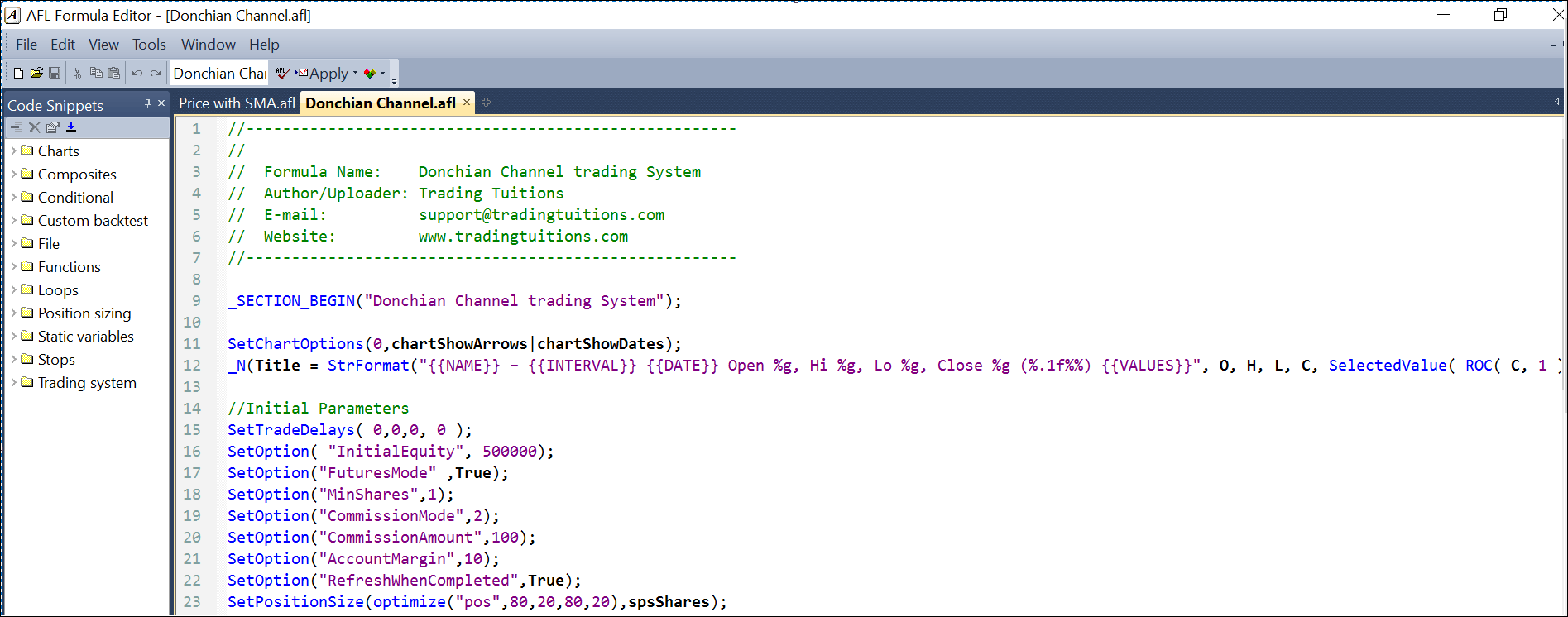

In Amibroker, you can craft trading strategies using the Amibroker formula language (AFL), incorporating technical indicators into your system logic. Visualize your strategy with helpful chart overlays.

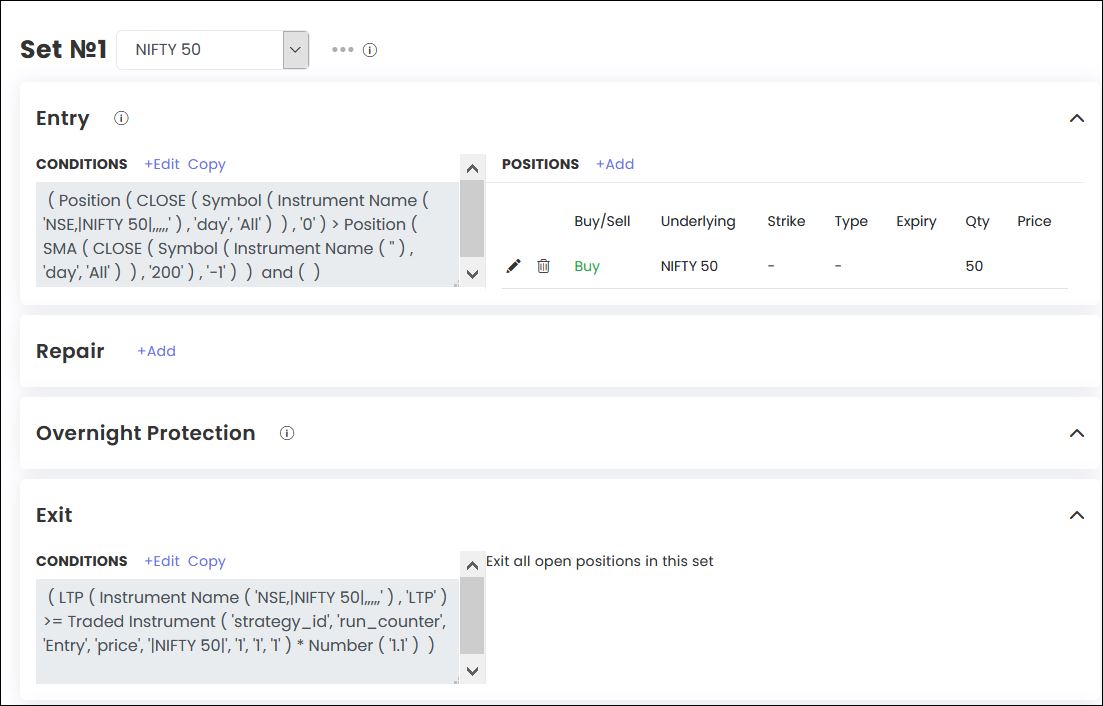

Tradetron simplifies strategy creation with a drag and drop interface, blending keywords and operators effortlessly. External Python libraries enhance this process. However, Tradetron lacks chart visualization for strategies.

The Automation Edge

Automation in Amibroker requires third-party plugins, varying by broker preferences.

Tradetron shines in automation, offering seamless integration with multiple brokers for instant, manual-free order placements.

Backtesting Brilliance

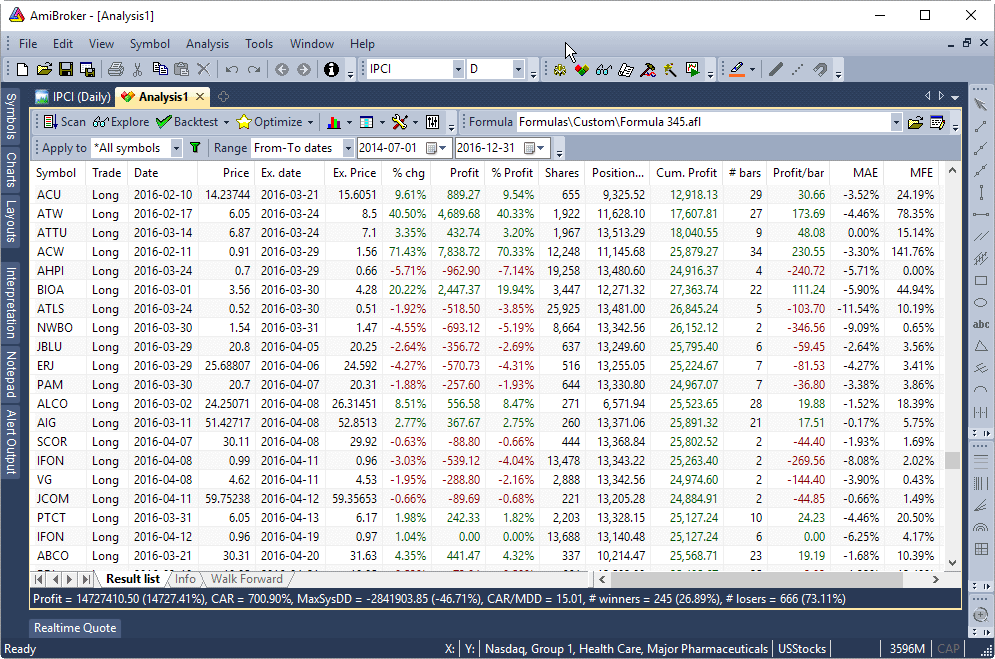

Amibroker is unrivaled in backtesting capabilities, offering ease of use, customizable metrics, and quick optimization options.

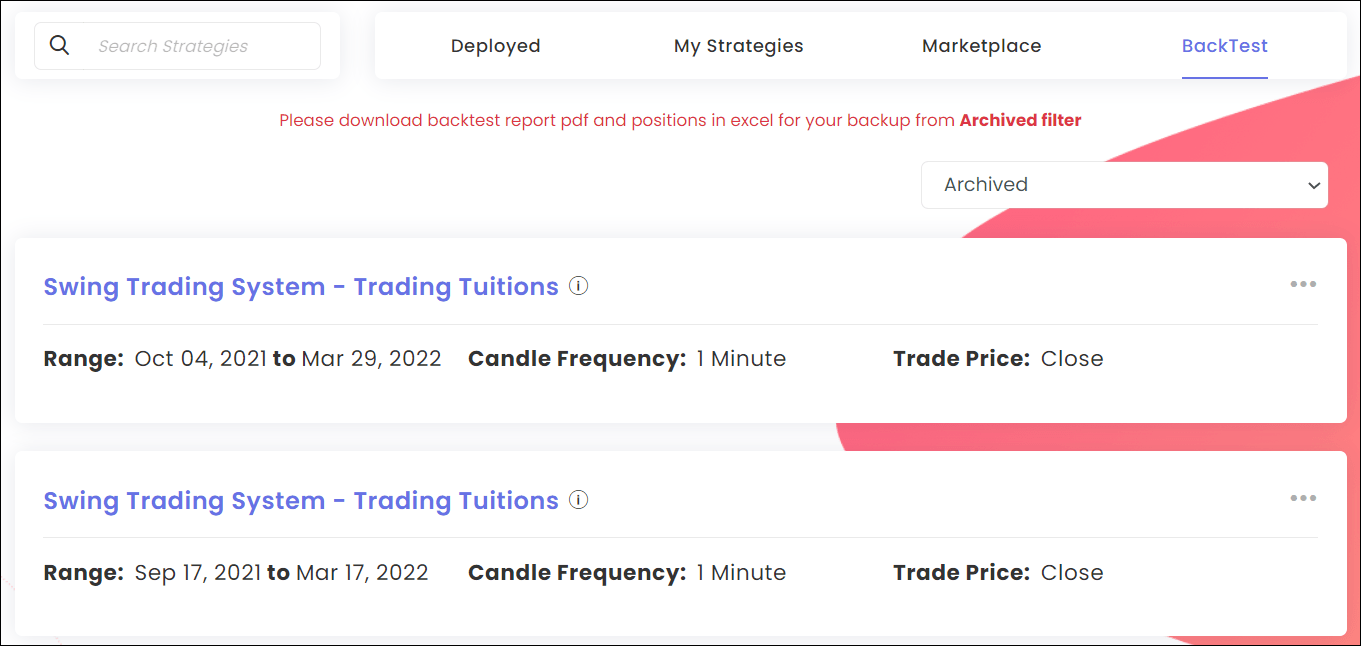

Tradetron’s backtesting is evolving, currently requiring more time for results compared to Amibroker’s swift execution.

Comparing Costs

Amibroker offers a one-time purchase starting at $299, with no recurring fees and regular updates. A trial version is available. See current prices at this link.

Tradetron’s plans range from 300 INR to 15000 INR monthly, with a free option for paper trading and one private strategy. No additional data subscriptions are needed. Latest pricing at [eafl id=”229868″ name=”Tradetron Pricing” text=”this link”].

Concluding Thoughts

While Amibroker and Tradetron each have their strengths, they serve different purposes within the realm of algo trading.

Tradetron focuses on automation, whereas Amibroker excels in technical analysis and system optimization. We recommend using both in tandem for a comprehensive trading experience.

One Comment