Welcome to AFL of the Week

Discover profitable AFLs for Amibroker without the hassle of coding or falling for scams. We provide ready-to-use AFL code and backtest reports, saving you time and money. In this article, we are going to discuss EMA crossover.

Read Also: A Trading System Utilizing Support and Resistance in AFL

Strategy Overview

| Parameter | Value |

| Preferred Timeframe | Daily |

| Indicators Used | 14-period EMA, 73-period EMA |

| Buy Condition | 14-period EMA crosses above 73-period EMA (Buy at the next day’s Open) |

| Sell Condition | 14-period EMA crosses below 73-period EMA (Sell at the next day’s Open) |

| Stop Loss | No fixed stop loss; Stop and reverse when AFL gives an opposite signal |

| Targets | No fixed target; Stop and reverse when AFL gives an opposite signal |

| Position Size | 150 (fixed) |

| Initial Equity | 200,000 |

| Brokerage | 50 per order |

| Margin | 10% |

AFL Code for EMA Crossover

//------------------------------------------------------

//

// Formula Name: 14-73 Crossover Trading System

// Website: zerobrokerageclub.com

//------------------------------------------------------

_SECTION_BEGIN("14-73 Crossover Trading System");

SetChartOptions(0,chartShowArrows|chartShowDates);

_N(Title = StrFormat("{{NAME}} – {{INTERVAL}} {{DATE}} Open %g, Hi %g, Lo %g, Close %g (%.1f%%) {{VALUES}}", O, H, L, C, SelectedValue( ROC( C, 1 ) ) ));

//Initial Parameters

SetTradeDelays( 1, 1, 1, 1 );

SetOption( "InitialEquity", 200000);

SetOption("FuturesMode" ,True);

SetOption("MinShares",1);

SetOption("CommissionMode",2);

SetOption("CommissionAmount",50);

SetOption("AccountMargin",10);

SetOption("RefreshWhenCompleted",True);

SetPositionSize(150,spsShares);

SetOption( "AllowPositionShrinking", True );

BuyPrice=Open;

SellPrice=Open;

ShortPrice=Open;

CoverPrice=Open;

//Parameters

MALength1 = 14;

MALength2 = 73;

//Buy-Sell Logic

Buy = Cross(ema( C, MALength1 ),ema( C, MALength2 ));

Sell =Cross( ema( C, MALength2 ), ema( C, MALength1 )) ;

Buy = ExRem( Buy, Sell );

Sell = ExRem( Sell, Buy );

Short = Sell;

Cover = Buy;

Plot( Close, "Price", colorWhite, styleCandle );

Plot(ema( C, MALength1 ),"FastEMA",colorWhite);

Plot(ema( C, MALength2 ),"SlowEMA",colorBlue);

/* Plot Buy and Sell Signal Arrows */

PlotShapes(IIf(Buy, shapeSquare, shapeNone),colorGreen, 0, L, Offset=-40);

PlotShapes(IIf(Buy, shapeSquare, shapeNone),colorLime, 0,L, Offset=-50);

PlotShapes(IIf(Buy, shapeUpArrow, shapeNone),colorWhite, 0,L, Offset=-45);

PlotShapes(IIf(Cover, shapeSquare, shapeNone),colorGreen, 0, L, Offset=-40);

PlotShapes(IIf(Cover, shapeSquare, shapeNone),colorLime, 0,L, Offset=-50);

PlotShapes(IIf(Cover, shapeUpArrow, shapeNone),colorWhite, 0,L, Offset=-45);

PlotShapes(IIf(Sell, shapeSquare, shapeNone),colorRed, 0, H, Offset=40);

PlotShapes(IIf(Sell, shapeSquare, shapeNone),colorOrange, 0,H, Offset=50);

PlotShapes(IIf(Sell, shapeDownArrow, shapeNone),colorWhite, 0,H, Offset=-45);

PlotShapes(IIf(Short, shapeSquare, shapeNone),colorRed, 0, H, Offset=40);

PlotShapes(IIf(Short, shapeSquare, shapeNone),colorOrange, 0,H, Offset=50);

PlotShapes(IIf(Short, shapeDownArrow, shapeNone),colorWhite, 0,H, Offset=-45);

_SECTION_END();

Backtest Report

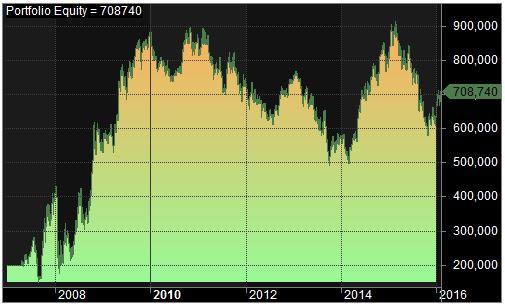

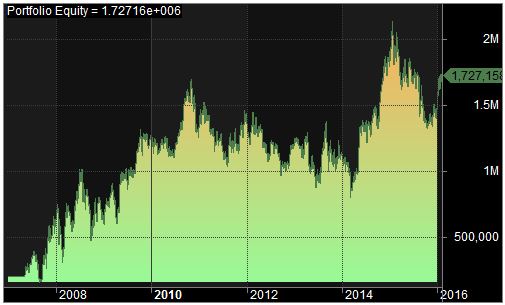

| Parameter | Value | |

|---|---|---|

| Nifty | Bank Nifty | |

| Initial Capital | 200,000 | 200,000 |

| Final Capital | 708,740 | 1,727,157.50 |

| Backtest Period | 02-Jan-2007 to 09-02-2016 | 02-Jan-2007 to 09-02-2016 |

| Net Profit % | 254.37% | 763.58% |

| Annual Return % | 14.90% | 26.70% |

| Number of Trades | 36 | 36 |

| Winning Trade % | 22.22% | 38.89% |

| Average Holding Period | 61.28 periods | 60.92 periods |

| Max Consecutive Losses | 9 | 4 |

| Max System % Drawdown | -59.29% | -59.40% |

| Max Trade % Drawdown | -22.08% | -97.77% |

Download the detailed backtest report here.

Equity Curve

Nifty:

Bank Nifty:

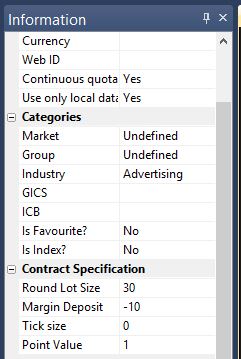

Additional Amibroker Settings for Backtesting

Go to Symbol → Information and specify the lot size and margin requirement. For example, lot size of 30 and margin requirement

of 10% for Bank Nifty: