Revolution in Algorithmic Trading: Over the last decade, algorithmic trading has emerged as a groundbreaking trend in the financial market. This approach is increasingly embraced by traders in equities, commodities, and forex, including retail investors. In the U.S. alone, automated systems execute approximately 75% of trades, a trend that is on the rise globally. This article will explore five outstanding algorithmic trading platforms to help you develop your trading systems.

Defining an Algorithmic Trading Platform

Let’s clarify what an algorithmic trading platform is. Simply put, it’s software that assists in coding, testing, and running your trading algorithms. This tool can be a desktop program, a mobile application, or a web-based tool.

Algorithmic trading transforms your trading strategies into computer code for automatic or semi-automatic order execution. These platforms streamline this process by offering a host of built-in features and services.

Key Reminder: While algorithmic trading platforms are essential in creating trading systems, they’re not the only ingredient for success in algorithmic trading. For a more in-depth understanding, consider reading this article on the basics of algorithmic trading, and this one for insights on developing and implementing a trading system from scratch.

Essential Features of an Algorithmic Trading Platform

An effective algorithmic trading platform should ideally include these fundamental features:

- Capability to transform trading rules into algorithms

- Tools for backtesting algorithms with historical data

- Pre-built technical indicators for use in algorithms

- Graphical representation of stock data

- Stock scanning tools based on algorithm criteria

- Position sizing and risk management utilities

- Email or community support for troubleshooting

If any of these seven features is missing in a platform you’re evaluating, it might be best to reconsider your choice!

Whether it’s web-based, a desktop app, or a mobile application, each format has its merits. For complex tasks, desktop applications are recommended, though web-based tools are also useful. Mobile apps are great supplements but might not suffice as standalone solutions.

Further Reading: Mastering Backtesting Trading Strategies for Market Success

Top Platform Recommendations

Among the numerous algorithmic trading platforms launched annually worldwide, only a select few rise to prominence.

We’ve evaluated about 50 platforms, narrowing it down to 5 outstanding choices based on the following criteria:

- Inclusion of the seven key features mentioned earlier

- Global availability, regardless of your location

- User-friendliness for beginners with no programming background

Here are our recommendations, presented in no particular order:

Note: Our review is unbiased, with no affiliations to any of these tools or platforms.

Quantopian

Quantopian stands out as a premier platform for retail traders to research and develop trading strategies. It offers a Python-based interactive development environment (IDE) for coding and backtesting, complemented by a plethora of free educational resources.

Quantopian provides a wealth of free historical datasets for backtesting. Traders can also engage in contests, potentially licensing their algorithms for profit sharing. The platform fosters a collaborative environment for discussion and support within its rapidly growing community.

While it previously allowed direct algorithm integration with broker terminals, Quantopian now focuses solely on research and backtesting, making it a non-automated solution.

Founders: John Fawcett and Jean Bredeche

Established in: 2011

Website: http://www.quantopian.com/

Type: Web-based

Cost: Free with premium data sets available for purchase

Unique Features: Complimentary data, educational content, and periodic contests

Supported Programming Language: Python

Note: In November 2020, Quantopian announced its integration with Robinhood, a U.S.-based financial services company.

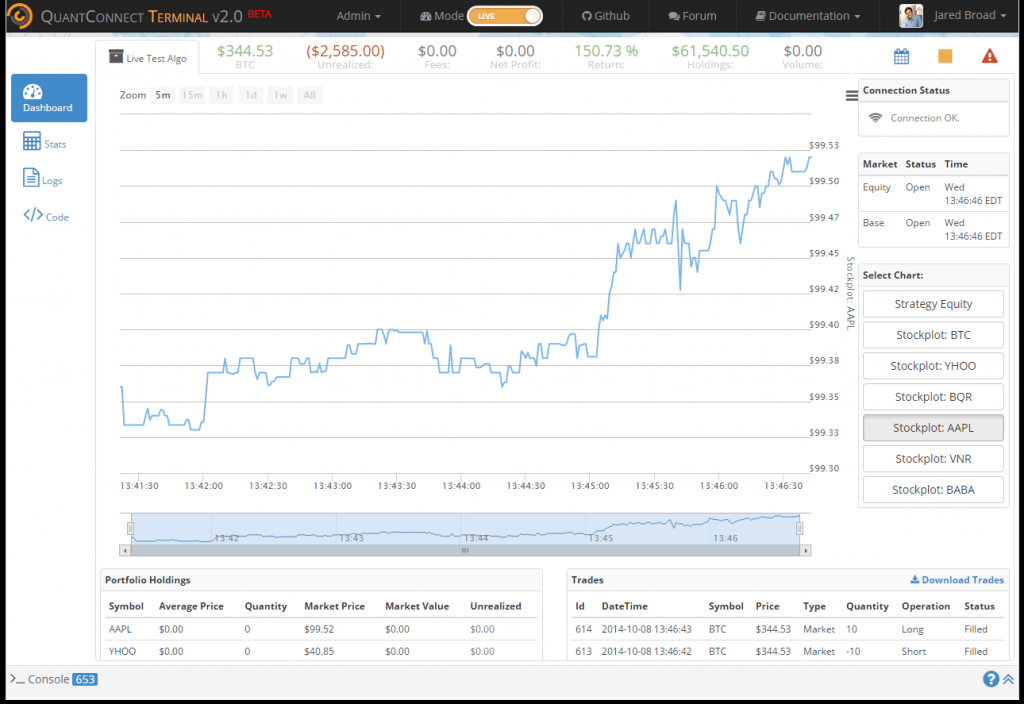

QuantConnect

QuantConnect is a versatile cloud-based platform for coding, backtesting, and optimizing trading strategies. It supports multiple programming languages (C#, F#, Python) and offers direct deployment to broker environments.

The platform provides an extensive 400TB tick data library for testing various assets, including Crypto, Forex, and CFD. It also has interactive community features and an instant messaging tool for enhanced collaboration.

Founders: Jared Broad

Established in: 2011

Website: https://www.quantconnect.com

Type: Web-based

Cost: Free community edition; Premium packages starting at $20/month

Unique Features: Multi-language support, broker integration, and fast execution

Supported Programming Languages: C#, F#, Python

Getting Started: Follow these step-by-step instructions to begin with QuantConnect.

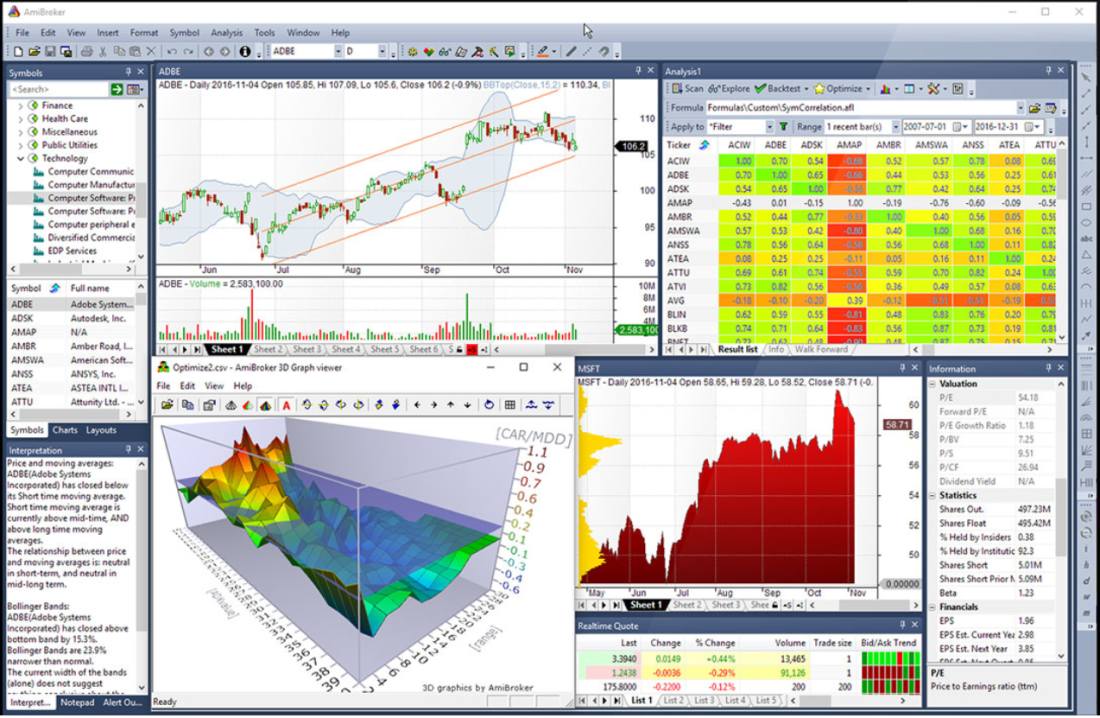

Amibroker

Amibroker, developed by Dr. Tomasz Janeczko, is a robust technical analysis and algorithmic trading software available for Windows PCs. Launched in 1995, it’s among the oldest and most refined platforms in this comparison.

Amibroker’s superior speed and efficiency stand out, especially in backtesting, which is significantly faster than competitors like Quantopian and NinjaTrader. Its multi-threaded architecture and AFL programming language contribute to this high performance.

The software’s user-friendly interface is ideal for beginners, with drag-and-drop features simplifying algorithm development. Amibroker also integrates well with various data vendors and brokerages, facilitating seamless algorithmic trading.

Founder: Dr. Tomasz Janeczko

Established in: 1995

Website: https://www.amibroker.com

Type: Desktop application

Cost: Free trial available; Premium license starts at $279

Unique Features: Intuitive learning curve, high-performance capabilities, comprehensive package

Supported Programming Language: Amibroker Formula Language (AFL) based on C

Getting Started: Begin with the official user guide here.

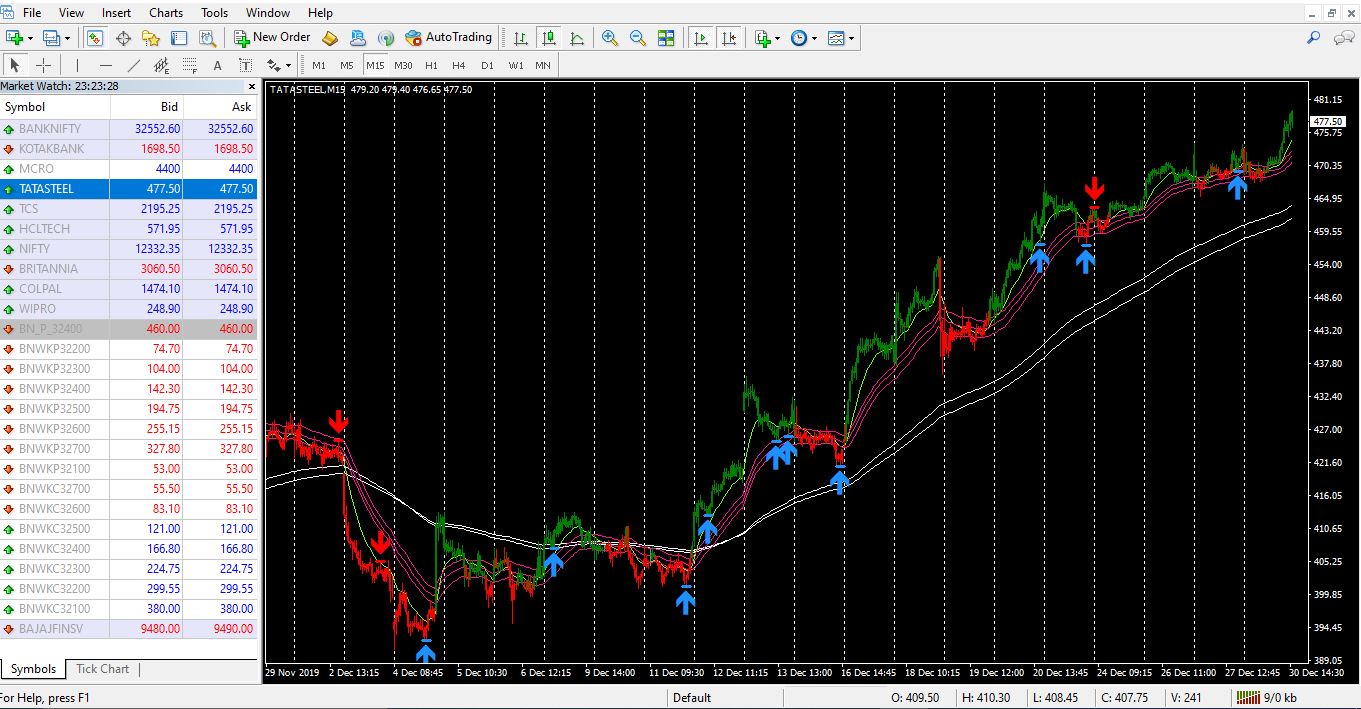

Introducing MetaTrader

MetaTrader stands out as the most recognized platform for algorithmic trading, having its roots as a charting tool and progressively expanding into the realm of automated trading.

MetaTrader stands out as the most recognized platform for algorithmic trading, having its roots as a charting tool and progressively expanding into the realm of automated trading.

MetaTrader offers two versions: MT4 and MT5. MT4 is more widely adopted by brokers and traders, while MT5, the newer version, incorporates several advanced features.

Both MT4 and MT5 have mobile applications in addition to their desktop versions, a boon for traders who need to operate on the move.

MT5 is not merely an enhanced version of MT4; they target different users. MT4 excels in forex trading, whereas MT5 is versatile, suitable for forex, stocks, and futures trading.

These platforms enable you to create your own trading robots or purchase existing ones from their marketplace. They also offer a convenient copy trading feature.

Key features of MT4 and MT5 include support for multiple timeframes, a range of technical indicators, drawing tools, and expert advisors. A notable feature is the option to rent a virtual server, ensuring your trading algorithms are always active.

Created By: Metaquotes Software Corp

Launch Year: 2005

Official Website: https://www.metatrader5.com/ or https://www.metatrader4.com/

Platform Type: Desktop and Mobile App

Pricing: Free, with additional costs for data subscription

Why Choose MetaTrader?: Algo trading robot marketplace, VPS rental, Extensive user base

Supported Programming Languages: MQL4, MQL5 (C++ based)

Getting Started: Check out the official getting started guide to learn about MetaTrader.

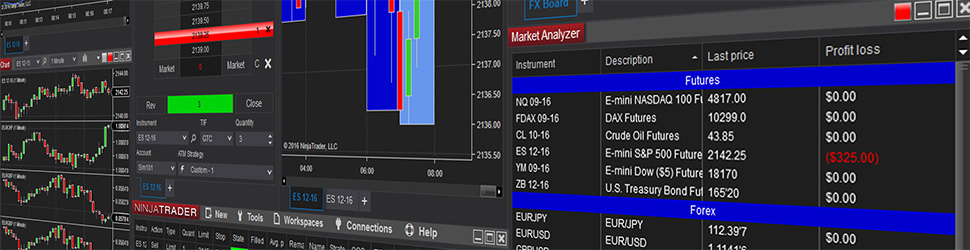

Exploring NinjaTrader

NinjaTrader, a US-based brokerage and algo trading platform, requires a local computer installation for access.

NinjaTrader, a US-based brokerage and algo trading platform, requires a local computer installation for access.

Its user-friendly interface includes advanced charting capabilities often lacking in web platforms. NinjaTrader allows in-depth order flow analysis and market depth examination for predicting market trends.

The NinjaTrader Ecosystem offers numerous custom apps for a tailored trading experience. This community-driven ecosystem boasts a robust global membership, making NinjaTrader stand out among its peers.

NinjaTrader’s option chain analysis comes with sophisticated alert features. It provides complimentary data feeds for US markets initially.

NinjaTrader is built on a C# framework, enabling the creation of unique indicators, tools, and trading systems.

Founder: Raymond Deux

Inception Year: 2003

Website: https://ninjatrader.com

Software Type: Desktop application

Cost: Free for charting, testing, and simulation; paid subscriptions for live trading with brokerage integration. View pricing details here.

Main Features: Strong community backing, Superior graphic features

Programming Language: NinjaScript (C# based)

Starting Point: For NinjaTrader 8 tutorials, visit this link.

Comparative Overview

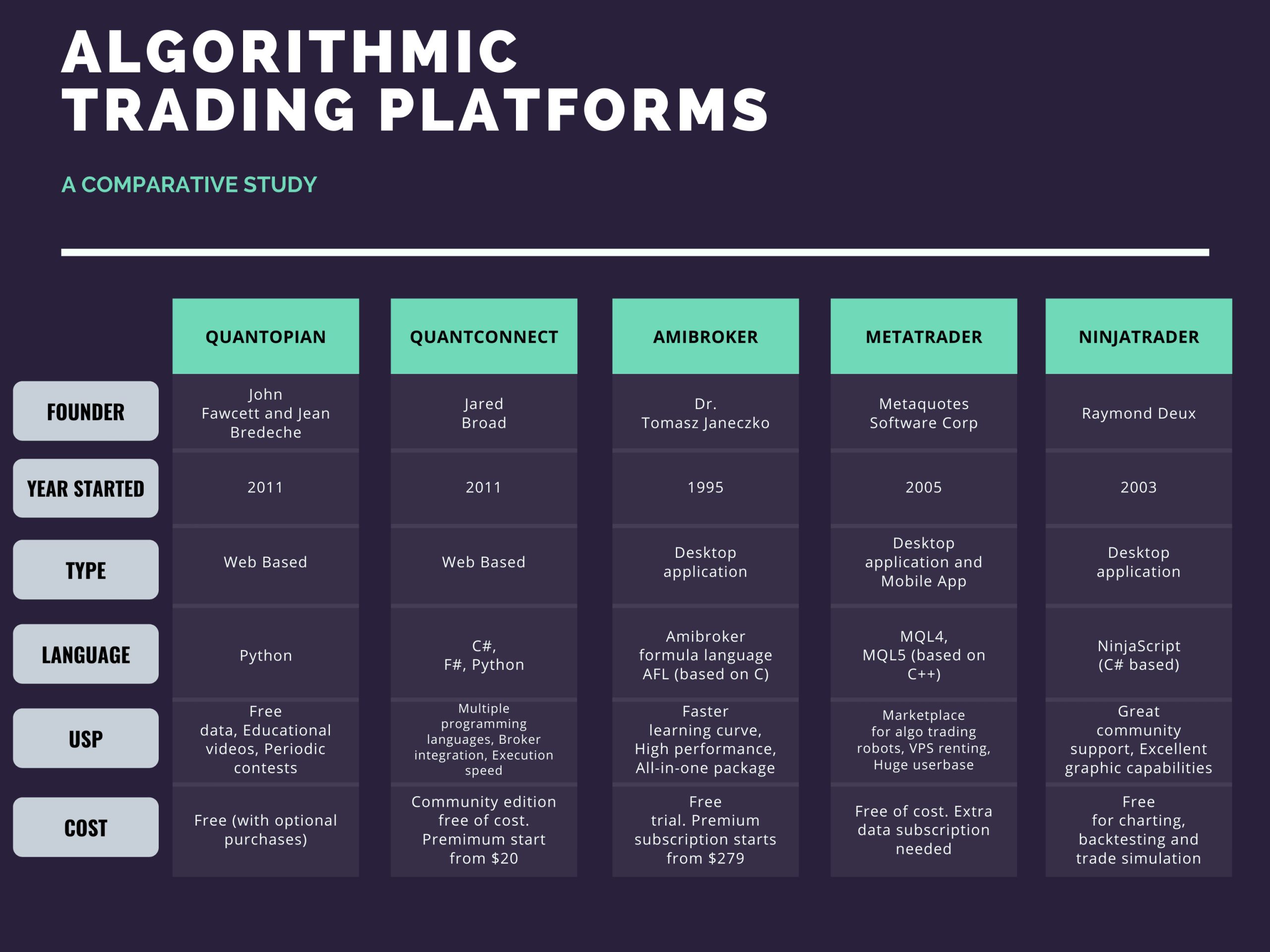

Below is a comparison chart of the top 5 algorithmic trading platforms we’ve reviewed.

Other Notable Algorithmic Trading Platforms

We’ve handpicked the best 5 algorithmic trading platforms based on various factors, including their global popularity among traders.

However, here are some additional platforms worth considering if they meet your specific needs:

- MetaStock

- Quantiacs

- AlgoTrader

- BackTrader

- QuantRocket

Concluding Thoughts

Choosing the right algorithmic trading platform is a significant decision, often involving years of evaluation by traders. This guide aims to simplify your choice by highlighting the key features of the top 5 platforms we have analyzed.

In brief:

- For Python enthusiasts who enjoy a competitive edge, consider Quantopian.

- If you’re interested in auto trading in addition to Quantopian’s features, Quantconnect is your ideal choice.

- For those who prefer ready-made trading robots and value community support and mobile accessibility, MetaTrader is recommended.

- If charting and visual analysis are your priorities, look no further than NinjaTrader.

- For high performance, simplicity, and reliability, Amibroker is the top pick.

Every platform has its pros and cons, so aim for the one that best addresses your needs rather than seeking perfection. Stick with your current platform unless there’s a compelling reason to switch, as adapting to a new platform can be time-consuming.

6 Comments