On popular demand, we’ve developed an Amibroker AFL for the Intraday Open High Low strategy. This strategy involves taking positions when the Open equals the High or Low for a given security in an Intraday timeframe. We’ve also provided an Excel sheet and Live signals for this system. Please refer to the following links:

In the next section, we’ll provide an AFL and backtest report for this Trading System. Click here to learn AFL coding and create your own Trading systems.

AFL Overview

| Parameter | Value |

| Preferred Timeframe | Intraday 5 minute |

| Indicators Used | None |

| Buy Condition | Open=Low in Intraday Timeframe post 30 minutes of market open |

| Short Condition | Open=High in Intraday Timeframe post 30 minutes of market open |

| Sell Condition |

|

| Cover Condition |

|

| Stop Loss | 0.5% |

| Targets | 2.5% |

| Position Size | 50% of Equity |

| Initial Equity | 200000 |

| Brokerage | 100 per order |

| Margin | 10% |

AFL Code

Download the AFL code from the link below:

//------------------------------------------------------

//

// Formula Name: Intraday Open High Low Trading System

// Website: https://zerobrokerageclub.com/

//------------------------------------------------------

_SECTION_BEGIN("Intraday Open High Low Trading System");

SetTradeDelays( 1, 1, 1, 1 );

SetOption( "InitialEquity", 200000);

SetOption("FuturesMode" ,True);

SetOption("MinShares",1);

SetOption("CommissionMode",2);

SetOption("CommissionAmount",100);

SetOption("AccountMargin",10);

SetOption("RefreshWhenCompleted",True);

SetPositionSize(50,spsPercentOfEquity);

SetOption( "AllowPositionShrinking", True );

SetOption("MaxOpenPositions",10);

BuyPrice=Open;

SellPrice=Open;

ShortPrice=Open;

CoverPrice=Open;

SetChartOptions(0,chartShowArrows|chartShowDates);

_N(Title = StrFormat("{{NAME}} – {{INTERVAL}} {{DATE}} Open %g, Hi %g, Lo %g, Close %g (%.1f%%) {{VALUES}}", O, H, L, C, SelectedValue( ROC( C, 1 ) ) ));

Plot( Close, "Price", colorWhite, styleCandle );

NewDay = (Day()!= Ref(Day(), -1)) OR BarIndex() == 0;

Plot(NewDay,"",colorlightGrey,styleHistogram|styleDots|styleNoLabel|styleOwnScale);

FirstTradeTime=094500;

SquareOffTime = 151500;

DayOpen=TimeFrameGetPrice("O",inDaily);

DayHigh = HighestSince(NewDay,H,1);

DayLow = LowestSince(NewDay,L,1);

printf("\nDayOpen : " + DayOpen );

printf("\nDayHigh : " + DayHigh );

printf("\nDayLow : " + DayLow );

Buy = (round(DayOpen)==round(DayLow)) AND High>=(sqrt(DayOpen)+0.0833)^2 AND (TimeNum() >= FirstTradeTime) AND TimeNum()<SquareOffTime;

Short = (round(DayOpen)==round(DayHigh)) AND Low<=(sqrt(DayOpen)-0.0833)^2 AND (TimeNum() >= FirstTradeTime) AND TimeNum()<SquareOffTime;

Sell = TimeNum() >= SquareOffTime;

Cover = TimeNum() >= SquareOffTime;

Buy=ExRem(Buy,Sell);

Sell=ExRem(Sell,Buy);

Short=ExRem(Short,Cover);

Cover=ExRem(Cover,Short);

printf("\nBuy : " + Buy );

printf("\nSell : " + Sell );

printf("\nShort : " + Short );

printf("\nCover : " + Cover );

StopLoss=0.5;

ApplyStop(Type=0,Mode=1,Amount=StopLoss);

Target=2.5;

ApplyStop(Type=1,Mode=1,Amount=Target);

/* Plot Buy and Sell Signal Arrows */

PlotShapes(IIf(Buy, shapeSquare, shapeNone),colorGreen, 0, L, Offset=-40);

PlotShapes(IIf(Buy, shapeSquare, shapeNone),colorLime, 0,L, Offset=-50);

PlotShapes(IIf(Buy, shapeUpArrow, shapeNone),colorWhite, 0,L, Offset=-45);

PlotShapes(IIf(Cover, shapeSquare, shapeNone),colorGreen, 0, L, Offset=-40);

PlotShapes(IIf(Cover, shapeSquare, shapeNone),colorLime, 0,L, Offset=-50);

PlotShapes(IIf(Cover, shapeUpArrow, shapeNone),colorWhite, 0,L, Offset=-45);

PlotShapes(IIf(Sell, shapeSquare, shapeNone),colorRed, 0, H, Offset=40);

PlotShapes(IIf(Sell, shapeSquare, shapeNone),colorOrange, 0,H, Offset=50);

PlotShapes(IIf(Sell, shapeDownArrow, shapeNone),colorWhite, 0,H, Offset=-45);

PlotShapes(IIf(Short, shapeSquare, shapeNone),colorRed, 0, H, Offset=40);

PlotShapes(IIf(Short, shapeSquare, shapeNone),colorOrange, 0,H, Offset=50);

PlotShapes(IIf(Short, shapeDownArrow, shapeNone),colorWhite, 0,H, Offset=-45);

_SECTION_END();

AFL Screenshot

Backtest Report

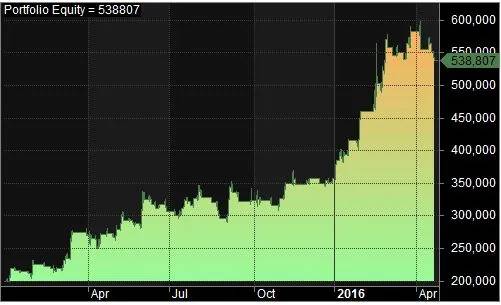

Here are the details of the backtest:

| Parameter | Value |

| Fixed Position Size | |

| Initial Capital | 200000 |

| Final Capital | 538807.42 |

| Scrip Name | NSE Nifty, NSE BankNifty |

| Backtest Period | 02-Jan-2015 to 26-Apr-2016 |

| Timeframe | 5 Minutes |

| Net Profit % | 169.40% |

| Annual Return % | 111.15% |

| Number of Trades | 130 |

| Winning Trade % | 48.46% |

| Average holding Period | 48.95 periods |

| Max consecutive losses | 8 |

| Max system % drawdown | -16.20% |

| Max Trade % drawdown | -11.64% |

Download the detailed backtest report here.

Equity Curve

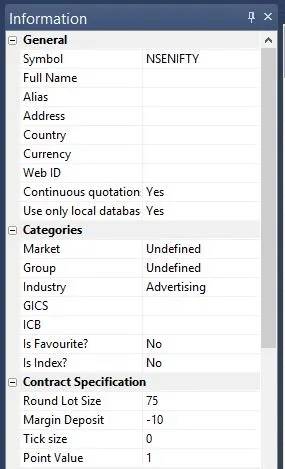

Additional Amibroker settings for backtesting

For additional settings, you can go to Symbol–>Information and specify the lot size and margin requirement. Here’s an example for NSE Nifty: